Road Transport Price Index – May ’23

9th June 2023

Road transport price index shows steady rise in overall prices, even as inflation falls

The overall Road Transport Price Index price-per-mile is still rising slightly to reach a record level for May, despite inflation finally dropping to single figures at 8.7%

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

TEG Road Transport Price Index - Trends at a glance

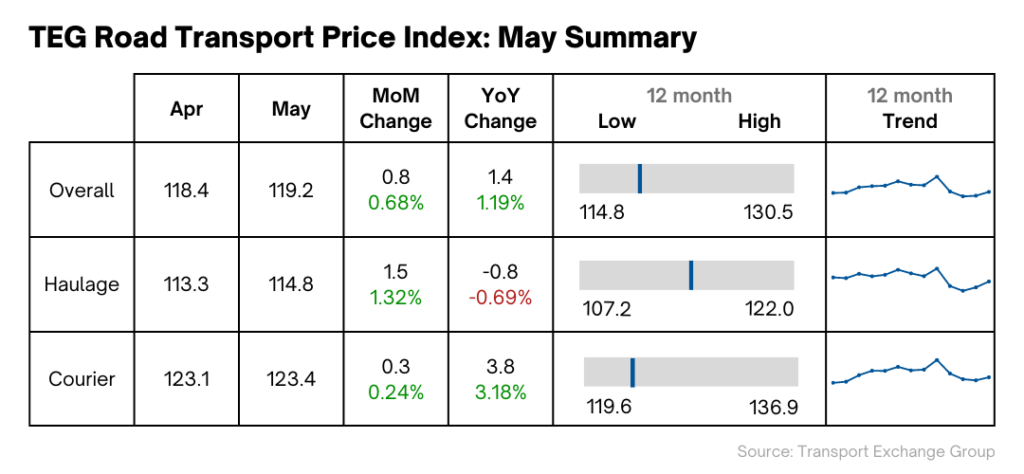

The latest data from the TEG Price Index reveals that the average price-per-mile for haulage and courier vehicles rose 0.8 points (0.7%) during May. Year on year, there was a 1.4-point (1.2%) increase, pushing the index to a record high for the month of May.

Courier prices are behind much of this year-on-year rise: they now sit almost 3.2% higher than they did in May 2022. This is despite a modest uptick of 0.2% over the last month. After much more dramatic hikes during spring in 2021 and 2022, courier price growth now appears to be slowing down.

Haulage prices still lag behind the overall index at 115.6, having grown by just 1.2% during May. Year on year, they’re still 0.7% lower than this time last year.

Industry pulse

Recent headlines have focused on falling inflation – but also noted that a bigger decrease was expected. Diesel prices have dropped as well, which is another very welcome development for the industry.

At the same time, road transport firms must contend with a hike in corporation tax, inflationary business pressures and continued driver shortages.

Yet, even with more affordable diesel filling their vehicles, operators still have EVs in their rearview mirror. They’re ever-mindful of the substantial costs involved, particularly when overheads are already stubbornly high.

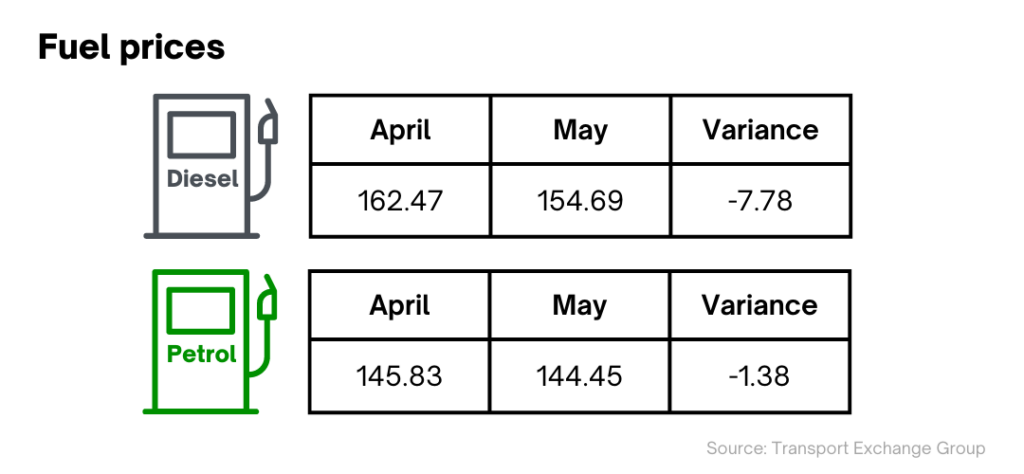

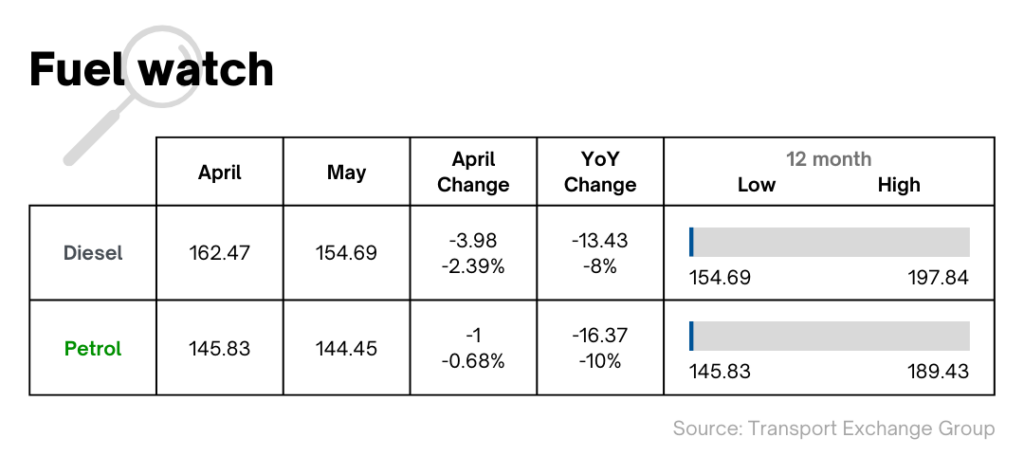

The long-awaited diesel price drop is picking up pace, it seems. Prices fell by 2% during April and 5% during May.

Petrol prices also dropped a little, but diesel prices are falling seven times as fast as petrol prices right now.

The gap between petrol and diesel at the end of May was around just 5p, leaving road transport operators feeling less aggrieved. But more important than that, of course, is the reduction in everyday costs that lower diesel prices bring.

Mixed economic news

With inflation falling to 8.7% from 10.1%, the Bank of England's predictions of a drop finally came to fruition. But although this was a return to single-figure inflation for the first time since August, the fall wasn't as sharp as expected. The central bank had forecast we'd see 8.2% inflation by now.

Plus, food price inflation is still hovering around record levels at 19.1%. Staples like milk (33%), bread (28%) and potatoes (28%) have risen by even more.

Fuel costs also remain high for both households and businesses. Household bills are around double what they were in October 2021, despite a lowering of the energy price cap in recent days.

All this maintains pressure on road transport companies to offer higher wages, not least because the Bank of England might well increase interest rates again, to 5.5%.

And already-limp UK economic growth will not be helped by these factors. However, the International Monetary Fund has said it now believes there will be modest growth this year: around 0.4%.

So there’s unlikely to be a growth-fuelled explosion in demand for road transport just yet, but demand for higher wages remains. With overheads still rising, not many operators will be thinking about dropping their own prices.

EVs emerging

The road transport industry is keenly aware of the government’s non-zero emission targets for HGVs. It’s now just 12 years until sales of sub-26 tonne HGVs end and 17 years for vehicles over 26 tonnes.

The government has yet to set out a detailed plan to enable this switch to electric HGVs – and operators would like to see more support. The Spring Budget was a disappointment to them as it was missing both meaningful fiscal incentives and action on charging infrastructure. The UK’s current public charging network for electric HGVs is inadequate – a major factor hindering the decarbonisation of the logistics sector.

Yet, if the government can improve the availability of charging infrastructure, EV uptake could rocket upwards.

In the UK, electric HGVs will soon be cheaper to own and run than diesel vehicles. A study by Element Energy by Transport & Environment UK shows that battery electric trucks are already cheaper than diesel vehicles for some uses. Even long-haul HGV jobs and supermarket deliveries will be cheaper with EVs by the early 2030s.

Encouraged by developments like this, global building solutions provider Holcim has recently ordered 1,000 electric trucks from Volvo Trucks. This is the largest commercial order for Volvo EVs so far.

Volvo Trucks itself is leaning heavily into EVs. By 2030, it has a target of EV sales making up half of all sales. By 2040, it wants to be only selling EVs.

Longer lorries

One interesting sustainability move from the government is a law allowing for longer semi-trailer combinations. They can now stretch out to 18.55 metres, 2.05 metres more than before.

It’s hoped that this legislation will reduce carbon dioxide emissions by tens of thousands of tonnes.

But the benefits are also financial. By boosting productivity and creating efficiencies, the government expects this change to make as much as £1.4 billion for the UK economy.

In summary

In the long term – or perhaps even the medium term – sustainability efforts will pay dividends, particularly with EV operating costs coming down.

However, without significant government backing for EV infrastructure, many companies will be hesitant to make the heavy investment that going electric requires. Those that do make such an investment will look to claw some of it back to guarantee financial viability, which will mean higher road transport prices.

Prices are also being influenced by the uncertain economic climate the UK is still enduring. Of course, any drop in inflation is a positive, but operators and businesses in general would’ve hoped for a more significant fall – ideally coupled with stronger growth.

Plus, the cost of living continues to drive demand for higher salaries and, in turn, increases in road transport prices. Companies throughout the sector will be carefully monitoring the Bank of England’s next move, hopeful that inflation can be brought lower and they can enjoy lower costs.

Come back next month to see how the Road Transport Price Index changes through June.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn