The TEG Road Transport Price Index – October 2024

4th November 2024

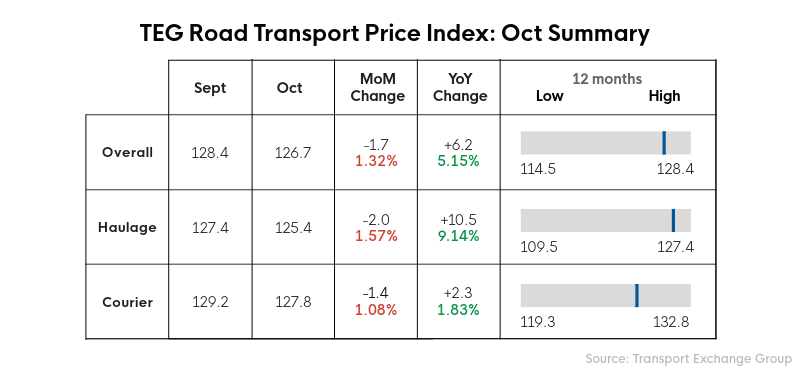

October saw a slight drop in the overall TEG index, visible across both haulier and courier prices.

Index trends at a glance

The TEG Road Transport Index fell 1.7 points to 126.7 in October. This 1.32% drop reflects the trend we saw in both 2023 and 2022.

Looking at the haulage sector, the index slipped to 125.4. This was a 2-point (1.57%) fall. But year-on-year, the index for hauliers was 9.14% and 10.5 points above October 2023.

The October index for couriers suggested a similar month-on-month situation. Falling 1.4 points to 127.8, this 1.08% drop was slightly less than hauliers saw. Compared to October 2023, courier prices were just 1.83% and 2.3 points higher last month.

Supporting the transportation industry with timely pricing insights, the TEG index demonstrated October performed as expected ahead of the busier festive season.

Industry pulse

There’s no doubt consumer confidence feels subdued right now. In the weeks running up to the Budget, speculation was rife about how the government might fill the reported “£20bn black hole”. This did nothing to lift the mood of the nation.

The GfK Consumer Confidence index slipped one point to -21 in October and the BRC reported -2.1% non-food deflation as people chose to spend less on non-essentials. But, in contrast, the economy looks more promising. Interest rates and inflation are relatively stable, and the IMF expects the UK economy to grow by 1.1% in 2024, up from its previous estimate of 0.7%.

Get free pricing updates once a month by email

So, why the divergence? Many feel it’s due to something called “Vibecession”, which describes a disconnect between actual and perceived economic performance. While you’d expect a stable economy to make consumers feel confident, other factors (such as anxiety about the Budget and poor summer weather) may have interfered with perceptions.

Now we’re the other side of the Budget, and with Christmas (and Black Friday) ahead of us, consumers should start to feel more optimistic. Christmas spending begins early for many, which presents an opportunity for the transport sector delivering goods to the right locations.

Fuel watch

Both diesel and petrol prices continued to fall during October. It’s a positive trend we’re becoming familiar with.

Diesel dropped 2.68p per litre (1.89%) to 139.13p. Year-on-year, the fall has been a staggering 23.05p per litre. In October 2023, diesel prices were 162.18p per litre. This 14.21% fall will be welcome news to both hauliers and couriers.

Meanwhile, petrol prices have fallen 2.83p per litre in October to 133.96p per litre. A month-on-month drop of 2.07%, the year-on-year reduction is more marked at 13.65%, a 21.17p per litre reduction.

Falling fuel prices have become the norm in recent months. This, plus the continued freeze on fuel duty announced in the Budget, should give the industry some comfort.

Fuel duty freeze positive Budget news for economic growth

Following the eagerly awaited Budget, the Chancellor confirmed a fuel duty freeze will continue, in addition to the 5p cut that was due to end in April 2025.

Hauliers are key to economic growth, and this should please the transportation industry, where fuel costs can account for up to 30% of overheads.

“The sector is vital to any plans to stimulate growth across the economy, and this respite is welcome news for a sector already seeing increasing business failures over the last year,” said David Wells, CE of Logistics UK.

The Chancellor announced an additional £500m would be spent on highway maintenance, but David Giles, chair of the Asphalt Industry Alliance, feels more is required: “With a one-time catch-up cost of £14.4 billion in England alone, this additional allocation is a fraction of what’s needed to prevent further decline.”

The industry also faces additional costs from the rise in employers’ national insurance to 15%, and a 6.7% increase in the minimum wage from April 2025. But the Chancellor also confirmed an increase in employment allowance to £10,500, extending this support to all eligible employers.

London DVS changes now enforceable

The next phase of London’s Direct Vision Standard (DVS) became enforceable from Monday 28 October. Eligible operators must ensure their vehicles have a permit or risk paying a £550 penalty charge and being unable to operate in London.

According to RHA and Logistics UK, 216,000 vehicles are in scope of the DVS Phase 2 regulations. Companies running HGVs over 12 tonnes must demonstrate their vehicles have a three-star safety rating, as specified by Transport for London (TfL), or fit a progressive safety system.

Haulage industry lobbying has resulted in a grace period for buying, fitting, and testing new equipment to comply with the PSS. This now runs until 4 May 2025.

In a joint statement, the RHA and Logistics UK said: “TfL has been clear from the outset that there will be leeway on the deadline for implementation, so it is up to operators to ensure they have installation works scheduled and, if necessary, have applied for the grace period in plenty of time, to ensure the sector can continue to deliver for London, its businesses and its consumers.”

Expert insight

“It always feels a bit surprising when spot rates move down in October as we enter the golden quarter for retailers and towards peak, but that’s exactly what they’ve done all years other than 2020 since the TEG indices were introduced. Both of the TEG haulage and courier indices are the second highest we’ve ever seen in October, and that makes sense – haulage was higher in 2021, the year of the driver crisis, and courier was higher in 2022 when fuel prices had been pushed up by the Ukraine invasion. The fuel price is back to a level last seen in 2021 - and, we now know, not about to suffer a duty increase!”

Kirsten Tisdale - Senior Logistics and Supply Chain Consultant - Aricia Ltd

In Summary

While the TEG index has fallen modestly in October, in line with the typical trend, other factors have made for an interesting month. This has also shown how valuable it is to access almost real-time transport pricing data via the index.

Fuel prices have continued to fall. Coupled with the Budget announcing a continued freeze on fuel duty, this should support industry performance in the months ahead. And yet, consumers remain cautious, despite a more stable economy. We’ve also learnt what Vibecession means.

The festive season couldn’t be better timed to lift consumer sentiment out of the doldrums and prompt additional spending. Those who like to plan early, plus Black Friday activities, will provide hauliers and couriers with opportunities for growth.

Share this post on LinkedIn