Road Transport Price Index – September ’23

12th October 2023

Biggest price rise in nine months as peak season approaches

The combined haulage and courier price jumps by 3.9 points as diesel prices pick up and confusion surrounds Net Zero plans

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

TEG Road Transport Price Index - Trends at a glance

September’s TEG Road Transport Price Index data reveals a significant jump in average prices. The overall price per mile for haulage and courier vehicles increased to 123.3, up from 119.4 in August. With an increase of 3.9 points, this is the largest jump since December 2022.

Year on year, the overall price was down 3.5 points, with courier prices also 4 points lower than last September.

But in the last month, courier prices increased by some 3.4 points, while haulage prices rose 4.1 points throughout September.

Industry pulse

Rishi Sunak’s Net Zero U-turn dealt a real shock to the industry. Some operators who use smaller vehicles will welcome more breathing room due to the extended deadline, while others will be frustrated that their planning for Net Zero is now premature.

Operators of larger vehicles are seeking clarity on whether their 2040 deadline still applies and how their plans will be affected. Some may be hoping that the reversal in policy could lower costs for emissions charges and similar measures. But until the policy is fleshed out, uncertainty reigns.

At the same time, the very fuel that Net Zero targets sought to wean the UK off is causing increasing costs for operators. Diesel prices are creeping up yet again.

However, hauliers and couriers will be looking forward to taking advantage of the bumper Christmas season – provided they have enough drivers to cover demand.

Fuel watch

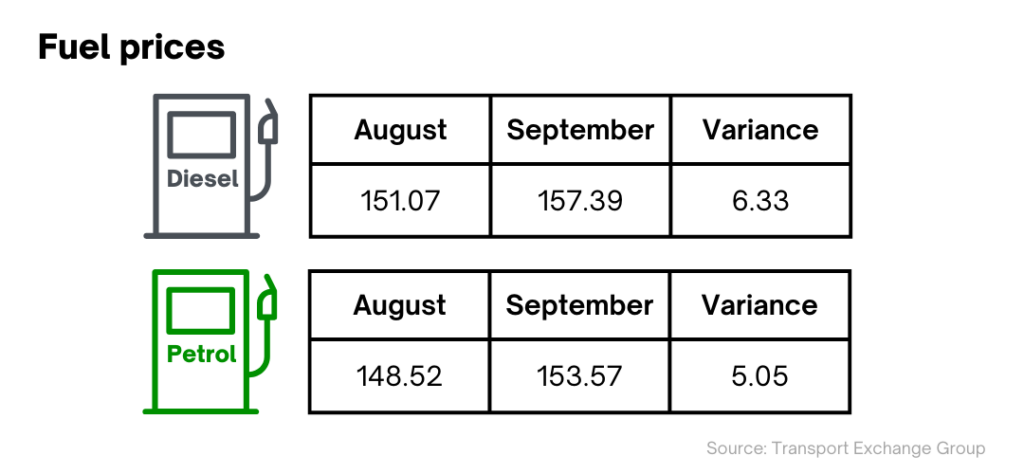

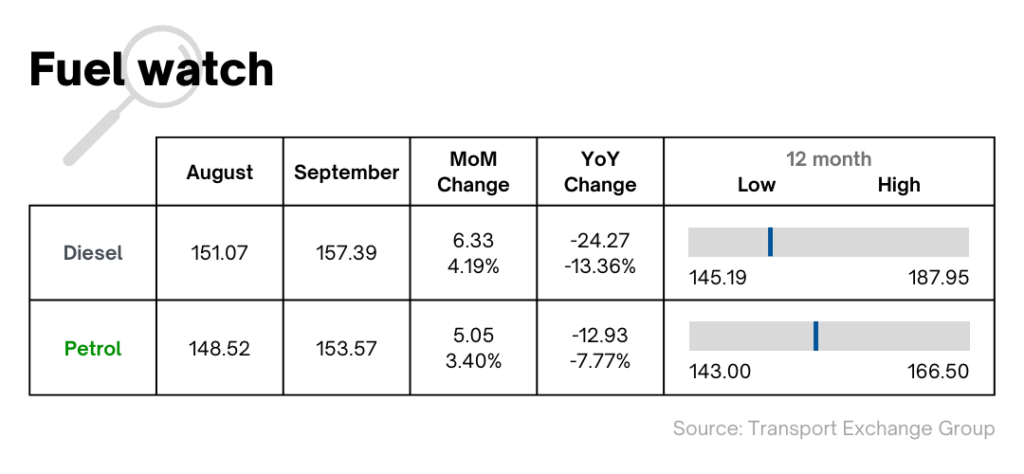

Fuel prices are once again on the rise, with average petrol prices over the month increasing by 3.4% and diesel rising by 4.19%.

This is now the third consecutive month of petrol price increases, with diesel rising for the second month in a row.

Fortunately, prices are still significantly lower than last year, when prices were at record highs due to a fall in refinery output and capacity and the fallout from Russia’s invasion of Ukraine.

Net Zero U-turn

On 20 September, Rishi Sunak confirmed a delay to phasing out new petrol and diesel car sales, pushing the deadline to 2035.

His justification for this major policy shift was following ‘a more pragmatic, proportionate, and realistic approach to meeting Net Zero that eases the burdens on working people’.

The changes to the UK's Net Zero plans will have a number of implications for haulage and courier drivers, fleets and companies. Many will fear that it’ll mean less investment in EV charging infrastructure, while other businesses will simply lament the lack of certainty.

The Department for Transport (DfT) offered no further detail following the Prime Minister’s announcement. And, frustratingly, there was no clarification on what may happen to the 2040 phase-out date for new large diesel lorry purchases.

The Road Haulage Association said: “We seek urgent clarity from government on what today’s announcement means for the future of HGVs and coaches. Businesses looking to play their part on the road to net zero need certainty, not delays.

“Government needs to collaborate with industry to come up with a detailed plan that provides certainty for investment, drives innovation, and directs support for those who want to do the right thing.

“We will continue to seek the clarity and certainty our industry urgently needs to bring costs down.”

Is technology the answer?

Amazon has recently unveiled an open-source tool that could help the government decide where to build EV charging points for HGVs. Charging Location for Electric Trucks (CHALET) takes data from road transport operators on routes, battery ranges and journey times. Using this data, the tool then creates a list of optimal charger locations.

Even if the government doesn’t invest heavily in EV charging, using technology like this would help get the most from more limited funding.

CDS in, CHIEF out

CDS is replacing the Customs Handling of Import and Export Freight (CHIEF) service and provides businesses with a more user-friendly, streamlined system that offers greater functionality. CDS has been running since 2018 and is already being used for making import declarations when moving goods into the UK.

Exporting companies will have to make the switch before April 2024 at the latest. But high-volume logistics hauliers and couriers face a 30 November 2023 deadline – and all companies are being advised to plan ahead.

The move will mean the UK is more closely aligned with international customs systems, making cross-border trade easier. Of course, smoother international trade will greatly benefit the logistics industry – and the wider economy.

Prepping for peak season

Significantly rising prices as early as September has raised some concerns for retailers as we near the peak Christmas season.

Revenue in the eCommerce market is projected to reach US$143.90bn in 2023. As of August 2023, internet sales made up 25% of all UK retail sales, which points towards a flood of demand for shipping and logistics companies.

Peak season runs from October to January each year. Many businesses will have to rely on external haulage and courier services to get their products from A to B and meet customer orders – and pay prices driven up by surging demand.

Influenced by the return of the HGV levy, fuel costs, higher business overheads and congestion charges, the traditional price uptick seems to have come earlier this year. As a result, many retailers will already be planning ahead to make sure their products aren’t left stranded in warehouses.

Sluggish growth goes on

Retailers won’t be alone in looking forward to strong demand in the run-up to Christmas. KPMG recently forecast that UK growth will slow to just 0.4% this year, down from 4.1% in 2022, and will slow further to just 0.3% in 2024.

So, many logistics companies will hope healthy demand over Christmas can boost those growth figures and leave UK growth figures looking more promising.

Otherwise, after the peak season has passed, hauliers and couriers might find they have to lower prices to attract business in a contracting economy.

In summary

Right now, the industry is facing unknowns around Net Zero targets. Uncertainty means previous and upcoming plans are being put on hold, particularly with new doubts about how forthcoming future EV infrastructure investment will be.

What’s for sure is that hauliers and couriers are raising their prices ahead of the traditional Christmas boom. The ongoing driver shortage could yet cause problems when demand rockets, which will add to price increases – as will surging diesel prices.

But no matter what’s happening around them, operators will be focusing on capitalising on peak Christmas demand – especially with the UK’s 2024 growth forecasts looking underwhelming.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn