Road Transport Price Index – September 2024

1st October 2024

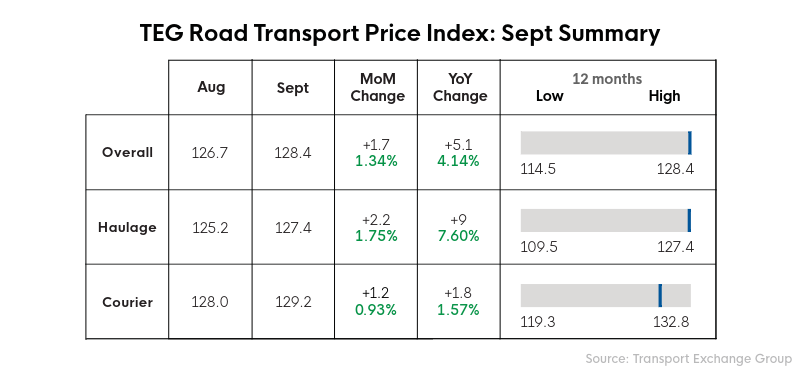

The TEG index climbed steadily in September across both haulage and courier prices.

Index trends at a glance

The overall TEG Road Transport Index rose 1.6 points to 128.3 in September. This 1.26% increase extended August’s return to a rising trend. Compared with September 2023, the index is now 5 points (4.06%) higher.

Following a robust rise last month, the haulage sector edged up a further 2.2 points (1.76%) in September to 127.4. While this eased year-on-year growth to 9 points (7.6%), the annual haulage price rise was still significant, possibly due to higher costs in the sector.

The courier index rise was modest in September. It rose just 1.1 points (0.86%) to 129.1. Annual growth was comparable: up 1.7 points (1.33%) since September 2023.

As autumn firmly arrives, there is no doubt transport prices are on the rise.

Get free pricing updates once a month by email

Industry pulse

In further encouraging news, the Barclays-BDO UK Logistics Confidence Index for 2024 has risen 10.3 points to 57.6. Barclays-BDO research suggests this may be due to more stable trading conditions, prompting many logistics operators to feel more positive, with 50% expecting profits to rise in the next 12 months.

The Bank of England has also sown seeds of positivity, reducing the interest rate to 5% on 31 July and maintaining this rate on 18 September, while inflation remained at 2.2%.

It is worth noting that September’s GfK Consumer Confidence Index fell by 7 points to -20 (still higher than 12 months ago). This is perhaps not surprising given the government has been talking about potential tax rises in the October Budget.

While events at home and overseas can influence our trading environment, many signs suggest the bigger picture is looking relatively positive for the UK logistics sector – especially with the Christmas season ahead of us.

Fuel watch

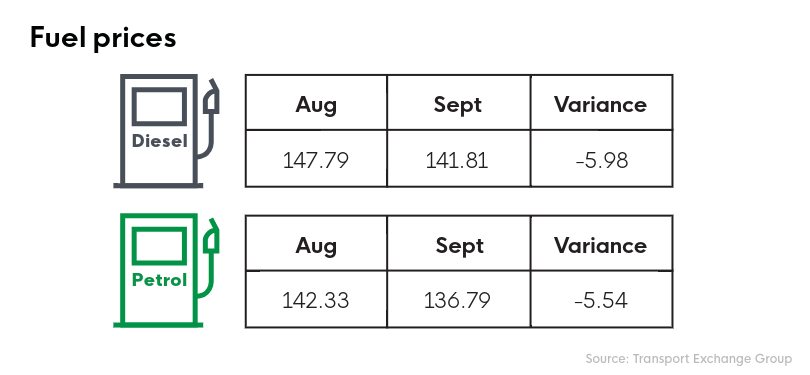

September saw a continued fall in fuel prices, which will be positive news for everyone in the transportation industry. Both petrol and diesel were more than 15p per litre lower than in September 2023.

Diesel prices led the September price fall, dropping 5.98p to 141.81p per litre. This 4.05% monthly fall compares to a 9.9% year-on-year price reduction when diesel prices were 15.58p per litre higher.

Also continuing the downward trend, petrol prices fell by 5.54p in September to 136.79p per litre. Aside from January (139.63p per litre) we haven’t seen petrol prices below 140p since October 2021. Mirroring diesel, the year-on-year drop is substantial: 16.78p per litre which is a 10.93% annual reduction.

While lower fuel prices are becoming familiar, history demonstrates how quickly things can change due to global events. We must remain mindful that the heightened instability across the Middle East could be a risk to future price stability.

New study suggests logistics sector could be in ‘remarkable recovery’ during 2024

The Barclays-BDO UK Logistics Confidence Index for 2024 has risen 10.3 points to 57.6. Aside from 2021 (the Covid bounce back), this is the highest level of confidence reported since 2015.

Such positive news, coupled with a stable period of low fuel prices, will be encouraging to those operating in the road transportation industry.

Research from Barclays Corporate Banking and accountancy and business advisory firm BDO LLP suggests the improvement may be due to a more stable overall trading environment, with 82% of logistics operators expecting business conditions to stay the same or get better in the next 12 months.

According to the research, this increased confidence has led logistics businesses to focus on increasing their market share, with 50% expecting their profits to rise in the next year.

Jason Whitworth, partner at BDO said: “This year’s Logistics Confidence Index is a remarkable recovery from 2023, when we saw business sentiment plummet in the face of challenging market conditions.”

Haulier concerns TfL’s faster bulk DVS grace period applications won’t prevent major bottleneck

From 1 October, TfL has opened a window for hauliers to submit bulk applications for Direct Vision Standard grace period permits. But it is only for those applying for more than 100 trucks, leaving many smaller operators with a lengthier process and the risk of a bottleneck building.

Without access to the bulk application method, hauliers must make one application per vehicle, creating a huge administrative burden ahead of the 28 October deadline.

Some hauliers are also reporting inconsistencies in outcomes for their single applications, despite them being identical. This is resulting in a frustrating situation for many operators in the sector.

RHA has recently raised concerns over the slow pace of applications.

Chris Ashley, RHA head of policy for environment and vehicles, said: “With time now ticking before the 28 October deadline, it is vital that TfL process DVS applications quickly and efficiently, with inconsistencies ironed out over whether an application is accepted. We want the process to be as smooth as possible for our members and we’ll continue to seek clarity on their behalf when it’s required.

Commenting on the new application method, TfL said: “This process is available to operators making grace period applications for more than 100 vehicles. We encourage operators to apply as early as possible in this window so that any unforeseen issues with their application can be resolved.”

Bulk applications can be made between 1 October 2024 and 23:59 on 27 October 2024.

Expert insight

“The TEG haulage index shows continued growth. Diesel costs are the lowest they’ve been for three years, implying that either capacity is down, or that volumes or costs, other than fuel, are up. It may well be a factor of all three, with capacity and driver costs potentially affected by the DQC* five-year renewal deadline.

Meanwhile current growth for the TEG courier index continues to be more restrained - no surprise as courier spot rates tend to be more closely aligned with diesel.”

Kirsten Tisdale - Senior Logistics and Supply Chain Consultant - Aricia Ltd

*The DQC (Driver Qualification Card) was introduced in September 2009. Lasting five years, drivers must carry out 35 hours of training to renew it. This five-year renewal cycle creates a peak in training demand. However, new drivers joining the industry will not coincide with this.

Large companies will be on top of their renewals. But because the previous government was talking about changing the requirements, it is thought that some individual drivers will have put off carrying out the necessary training. The DQC requirement has not gone away, and there are fines for not having a card.

In summary

It’s been another month of upward movement for the TEG Index, despite hefty fuel falls – one of the most significant costs for hauliers and couriers to bear. This may suggest there is less capacity, allowing for higher prices to prevail.

Suggesting signs of a logistics recovery, the Barclays-BDO UK Logistics Confidence Index is at its highest since 2015. Coupled with a recently reduced interest rate and the festive season ahead of us, this is encouraging news for transport operators.

Data, such as the TEG Index, can help transport companies make informed decisions in a constantly changing environment. With many businesses reportedly focusing on growth and profitability over the next 12 months, having access to in-depth pricing data could become a powerful tool.

Share this post on LinkedIn