Road Transport Price Index – October ‘2023

14th November 2023

Fuel prices ease as the road freight industry approaches the peak season

October sees a turn in haulage and courier costs, with a 2.8-point decrease, the most significant since February 2023

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

TEG Road Transport Price Index - Trends at a glance

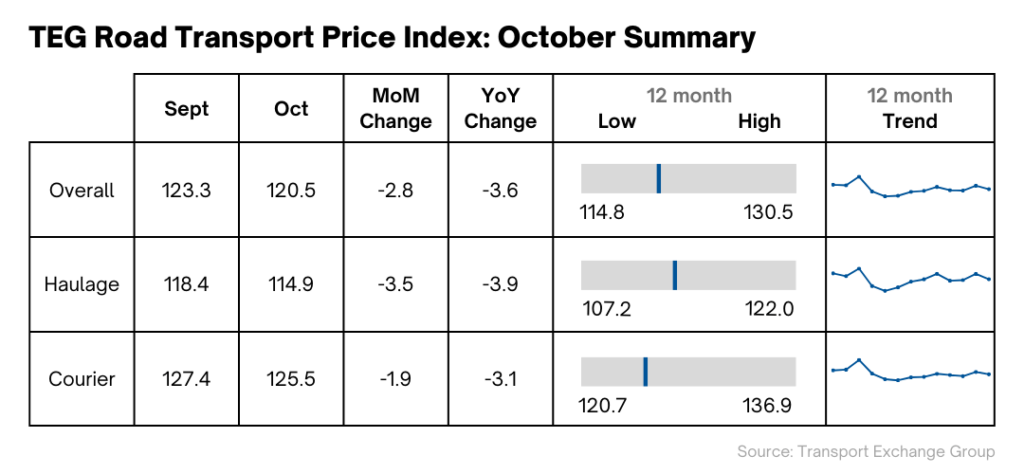

October data from the TEG Road Transport Price Index shows a considerable drop in the average price of haulage and courier vehicles over the course of the month. The overall price per mile for haulage and courier vehicles decreased from 123.3 to 120.5, a drop of 2.8 points. This is the largest fall in overall prices since February 2023.

This price drop was largely led by the change in haulage prices from 118.4 to 114.9. Courier prices also fell, although less significantly, down to 125.5 from 127.4.

Year on year, the overall price is down 3.6 points, with a similar decline in both haulage and courier prices.

Industry pulse

Rising fuel prices in the third quarter led some industry players to fear high costs would continue into the final quarter of the year as the UK heads into the peak season. However, fuel prices have steadied in the past month, offering a positive outlook for the busy period ahead.

Decarbonisation remains a key focal point for the industry, with the EU making significant legislative progress. In the UK, government funding announced in October could provide the much-needed boost to the UK's transition to zero-emission heavy goods vehicles (HGVs).

At the same time, the very fuel that Net Zero targets sought to wean the UK off is causing increasing costs for operators. Diesel prices are creeping up yet again.

Switching the 400,000 HGVs currently on UK roads to electric could potentially save 18.6 metric tons of carbon dioxide, equivalent to powering two million homes for a year.

Fuel watch

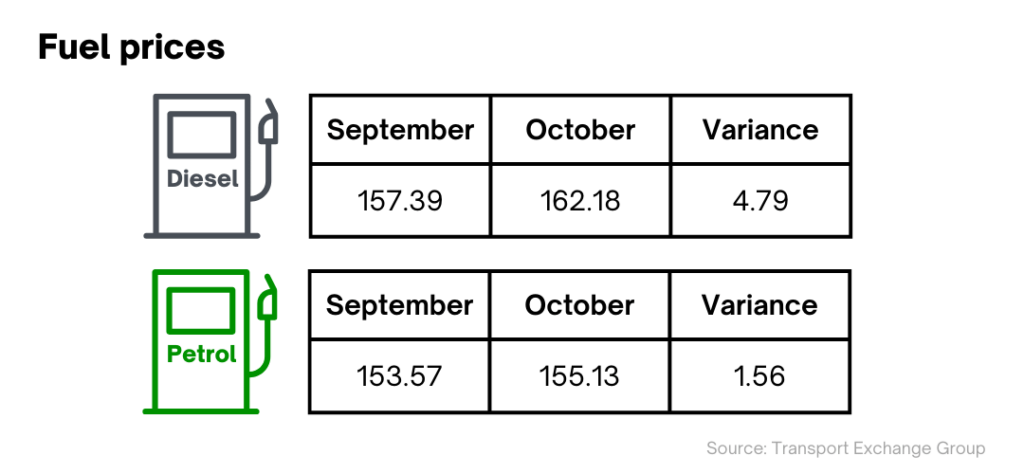

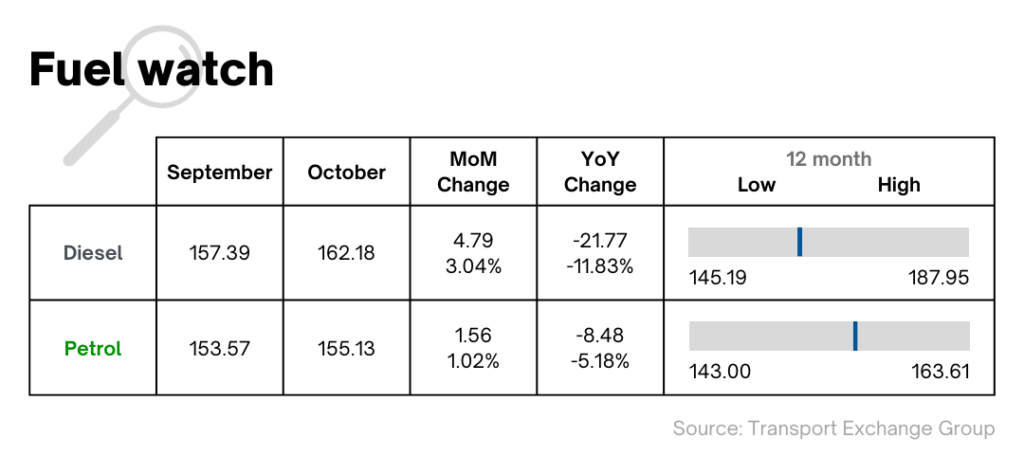

Fuel prices, which had been steadily climbing since mid-July, have begun to level out. Compared to a 5p increase in both August and September, average monthly petrol prices increased by only 2p in October. Fuel prices are now showing signs of decreasing as we enter November.

After petrol prices peaked at 156.02 and diesel prices at 162.49 in the first half of the month, fuel prices dropped as low as 153.97 and 161.76 respectively in the final week of October. Overall, the monthly average fuel prices were 155.13 pence/litre for petrol and 162.18 for diesel.

Despite the recent price fluctuations, the current fuel prices remain lower than they were during the same period last year.

UK government making strides in green transport investment

On 19th October, the UK government announced a significant investment of £200 million in the road freight sector to support the transition to greener road freight practices and achieving net zero. The investment will be shared across four green projects across the UK to roll out up to 370 zero-emission HGVs, including electric and hydrogen fuel cell vehicles.

The investment will also provide around 57 refuelling and charging sites to support sector decarbonisation by establishing the required charging infrastructure. A reliable charging network is crucial in allowing electric freight vehicles to gain enough power to reach their next destination in only a short stop without compromising the amount of freight the vehicle can carry.

The projects sharing the funding consist of eFREIGHT 2030 by Voltempo, Project Electric Freightway by GRIDSERVE, Project Zero Emission North (ZEN) Freight and Hydrogen Aggregated Logistics (HyHAUL) by Protium, each contributing to the production of vehicles and infrastructure that will reduce carbon emissions in the road freight industry. The project is also set to generate new jobs in the industry.

This investment will also aid major grocery chains in lowering their transportation emissions, mitigating the risk of rising delivery costs associated with volatile petrol and diesel prices, which could otherwise lead to potential food price increases. This sustainable investment is a significant step towards achieving a cleaner and more economically stable road freight industry, particularly with the 2040 zero-emission HGV deadline in mind.

EU outpaces the UK in decarbonisation progress

The UK's investment in decarbonisation signals that it is trying to keep pace with Europe, but further action is needed to match the EU's progress.

The EU has already adopted new legislation that will come into force in 2025, whereby fast charging stations will need to be present every 60 km along the core trans-European transport network (TEN-T) and every 100km of the larger TEN-T comprehensive network.

At the end of October, the EU Parliament's environment committee also backed the European Commission’s plans to cut HGV emissions. The plans involve targets to cut the average emissions of new freight trucks by 45% in 2030 and 90% in 2040, as well as ending the exemption of certain vehicles, such as refuse and construction trucks. The committee also called for a near phase-out of diesel trucks by 2035, with a target of 70% of all new truck sales being zero-emission by that date.

The committee has also rejected loopholes for e-fuels and biofuels, arguing that they are not sustainable and could maintain demand for fossil fuels. Instead, the committee emphasised the need for zero-emission trucks and improved trailer emissions performance.

Although the UK is no longer part of the EU, these targets will still affect UK fleet operators because many trucks used in the UK are manufactured in Europe.

The role of hydrogen in zero emissions

The landscape for achieving zero-emission HGVs and other large vehicles is more intricate than that for cars, largely due to the amount of power required for use and the long distances travelled. Hydrogen energy is emerging as a promising option to address some of these challenges.

Industry leaders are saying that hydrogen will play a pivotal role in the future of long-distance haulage. British multinational oil and gas company BP has outlined its ambitious plans to establish 25 hydrogen refuelling hubs across the UK by the end of the decade.

Whilst the head of UK fleet solutions at BP sees investment in hydrogen fuels as a complement to traditional fuel investment, the importance of hydrogen in the transportation and long-distance haulage sectors is clear.

Autumn statement expectations

Motorists who rely on roads for their work are eagerly awaiting Chancellor Jeremy Hunt's Autumn Statement on November 22 to learn how it will impact the industry.

One of their top concerns is road maintenance. RAC’s annual Report on Motoring found nearly half of drivers surveyed listed the condition of Britain’s roads as a top concern. The government recently pledged £8.3 billion in funding from the scrapped northern leg of the HS2 line plan to fix the UK's pothole problem. This funding is set to be released as early as April, and all regions of England will receive a share over the next 10 years. Fleet owners and drivers are keen to learn more about how this billion-pound funding plan will be implemented in the upcoming Autumn Statement.

Jeremy Hunt is also considering raising fuel duty for the first time in more than a decade. If this goes through, the adjustment is likely to elicit mixed reactions from the public.

In summary

Decarbonisation remains at the forefront of the UK’s net-zero agenda, as they announced their £200 million investment in the road freight sector to support the transition to greener practices this month. However, the EU is still ahead of the UK in decarbonisation efforts, with new legislation coming into force in 2025 requiring the more frequent presence of fast charging stations on major roads.

All efforts to improve the environmental impact of the road freight sector are welcome, and the UK’s investment will see major changes in the way the industry is able to operate.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn