Road Transport Price Index – January ’24

1st March 2024

Road freight prices drop in January for fourth consecutive year

January’s TEG Index data shows overall haulage and courier prices dropped significantly following the Christmas period, with prices lower than the same period last year.

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

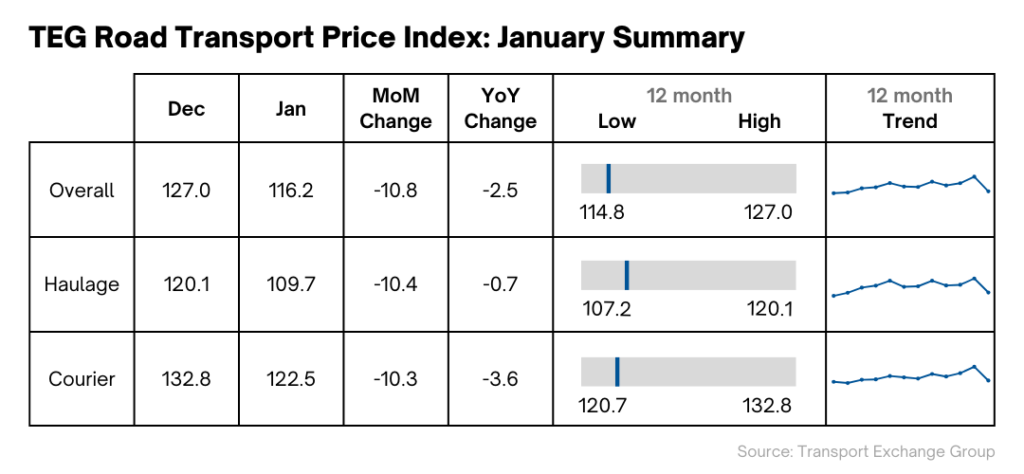

TEG Road Transport Price Index - Trends at a glance

January's data from the TEG Road Transport Price Index shows a steep decline in average haulage and courier vehicle prices over the course of the month. The overall price per mile for haulage and courier vehicles dropped from 127 to 116.2, a decrease of 10.8 points. This marks the lowest overall prices since March 2023, and lies 2.5 points lower year-on-year.

Both haulage and courier prices dropped by similar amounts from December, falling 10.4 and 10.3 points respectively. January’s haulage prices lie at 109.7 (down from 120.1) while courier prices fell to 122.5 (down from 132.8).

Industry pulse

These latest figures follow the same trend as in previous years, with post-Christmas prices dropping by 11.8 points in 2023 and 13 points in 2022. With fuel prices dropping and peak season winding down, operators have reduced prices accordingly.

Meanwhile, the UK road freight industry is so far relatively unaffected by the escalating Houthi attacks, with oil supply keeping up with demand despite disruptions to the supply chain. However, many operators will have begun contingency planning should the crisis severely impact the UK market, with potential for fuel shortages.

Industry leaders continue to innovate in green technology solutions, with more trials in zero emission HGVs taking place. With the deadline date for net-zero edging closer, we can expect trials to ramp up as we near 2025.

Fuel watch

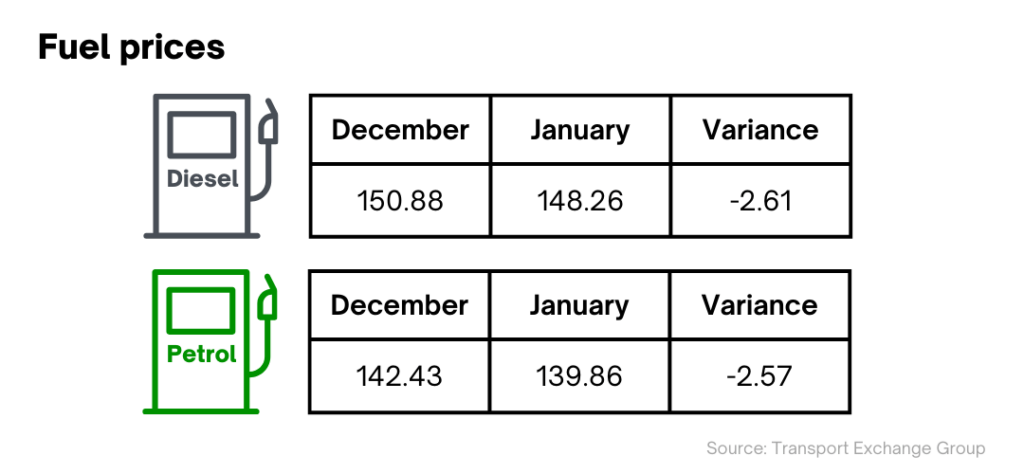

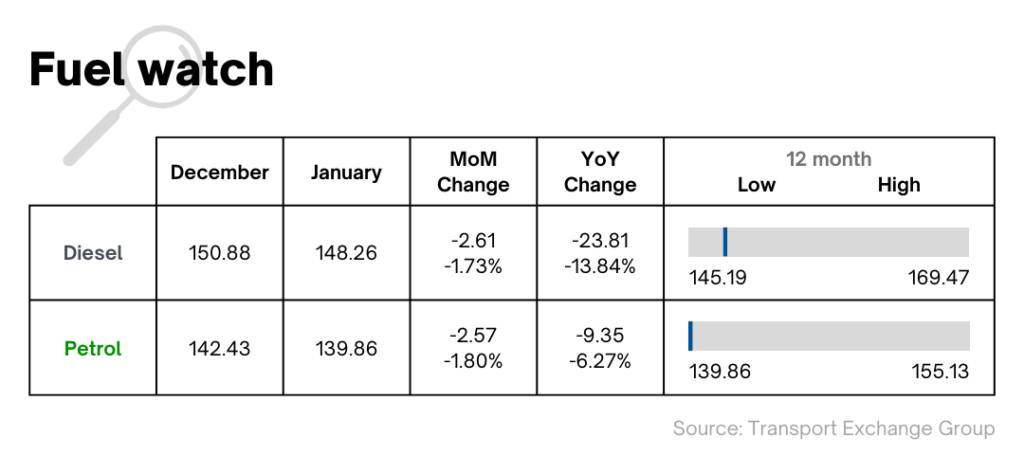

Fuel prices have dropped for the third month running, with reduced wholesale prices keeping figures down into January. Petrol prices lie at their lowest since October 2021, falling by 1.8% to 139.86p per litre (-2.57p change); meanwhile diesel prices are at their lowest since July 2023, dropping by 1.7% to 148.26p per litre (-2.61p change).

Prices are significantly lower than the same period last year; petrol prices are 12.87% lower, while diesel prices are 28.27% lower than last January.

With budgets tight in a year with significant expenditure expected for haulage businesses, lower fuel prices will allow hauliers extra breathing room where profit margins are tight.

Haulage driving innovation in tech

With net-zero targets looming, industry leaders are continuing investment in green technologies as fleets look to gradually transition to zero emissions.

Namely, Daimler Truck recently committed to exploring liquid green hydrogen supply options. Last month, Daimler signed a Memorandum of Understanding (MoU) to investigate the feasibility of liquid green hydrogen exports from Abu Dhabi (UAE) to Europe by 2030, with a view to incorporate it among their zero emissions fuel sources.

In other technological innovations, developments in autonomous trucking over the last year have brought the reality of driverless freight to the fore. Transport secretary Mark Harper stated in December that self-driving cars will likely be on UK roads by 2026, while Hydrogen Vehicle Systems (HVS) began development of two prototype self-driving HGVs last February in a £6.6m government-funded project. The developments aim to improve efficiency and productivity, while reducing carbon emissions by maintaining lower speeds and averaging more miles per gallon than manned trucks.

Needless to say, such developments come with controversy, with many HGV drivers having cause for concern over potential job losses. With drivers still in short supply, and autonomous truck technology still a way from satisfactory safety standards, the industry might be cautious in dissuading potential drivers from entering the profession.

New recruitment initiatives see uptake in HGV driver roles

The latest recruitment drive in encouraging new haulage talent has included the extension of government-run HGV bootcamps to February 2026.

Launched in 2021, the Skills Bootcamp in HGV Driving provides 16-week courses focusing on upskilling staff. With courses aiming to assist employees in gaining their category C and category C+E licences, the HGVC have claimed the bootcamps have been instrumental in boosting driver numbers, with over 25% of trainees coming from non-white backgrounds.

Supermarket brand Aldi has also recently announced intentions to recruit over 500 new apprentices across the UK in 2024, including trainee HGV drivers and warehouse and logistics workers. Incentives will include a number of benefits, such as in-shop discounts and financial advice, among others. The announcements also included new rates of pay for staff, with logistics and driver roles earning £10.96 and £14.13 per hour respectively.

With giants such as Aldi recognising the need to incentivise driver sign-ups, similar initiatives will need to be rolled out across the industry if recruitment drives are to be effective.

Road surfacing schemes stutter, with limited progress to show

Following the recent release of the RAC’s 2023 pothole index, questions have been raised on the progress of the government’s road resurfacing programme announced in November.

With the RAC attending nearly 30,000 pothole-related breakdowns over the course of the year – 33% more than 2022 – the UK’s roads continue to deteriorate, with no sign of advancement in the government initiative to resurface more than 5,000 miles of road across the country.

November’s announcement committed £8.3 billion of redirected HS2 funding to improving local roads, with local highway authorities receiving £150 million this financial year. However, with major progress yet to occur, road freight operators remain vulnerable to huge repair costs, with each journey placing strain on fleet vehicles’ upkeep.

Road freight operators are hopeful that 2024 will see some significant progress in the programme, but with transport policy implementation slow to action historically, we may yet see further delays.

In summary

With prices low, operators will be able to attract more business in the quieter months of the year, before prices are predicted to increase later on in 2024.

However, the upcoming year will be a challenging one for freight. Pressures continue to mount on smaller hauliers as they struggle with the transition towards zero emissions, with significant expenditure required to modernise fleets.

Despite this, advancements in technology should result in zero emissions vehicles becoming more affordable, as accessibility improves over the course of the next year.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn