November ’22

8th December 2022

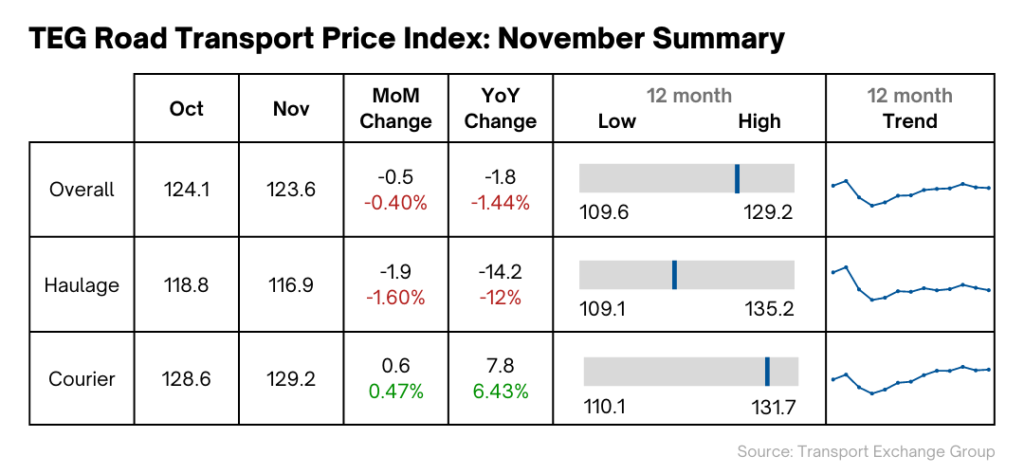

TEG Road Transport Price Index falls for second consecutive month ahead of traditional Christmas rush

Significant monthly fall of 1.9 points in haulage average price-per-mile outweighs increase of 0.6 points in courier price

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

The latest data from the TEG Price Index reveals that the average price-per-mile for haulage and courier vehicles dropped by 0.5 points in November. The haulage price index accounts for most of that decrease, having slid 1.9 points as the courier index recorded a 0.6-point rise.

The courier price index has now outstripped the overall price-per-mile average every month since February.

Compared to figures for both haulage and courier vehicles from last year, there has been a fall of 1.8 points. The courier index has continued its strong year-on-year growth, finishing November 7.8 points higher than last year, but haulage prices sit a huge 14.2 points (or 11%) lower than in November 2021.

Industry pulse

As the UK enters what is projected to be a two-year recession, road transport companies will be watching Christmas retail sales closely. The price index usually rockets upwards in line with Christmas demand, but that rise could be somewhat muted this year as consumers deal with dramatic cost of living rises.

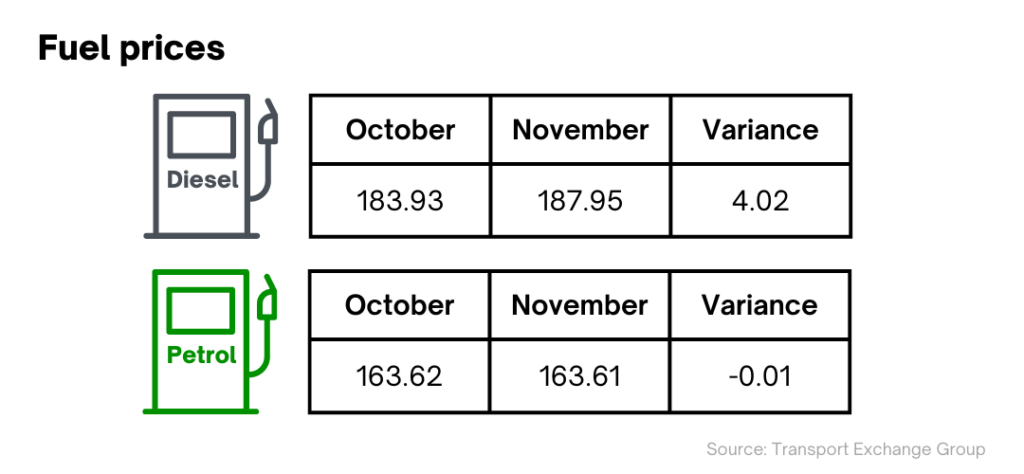

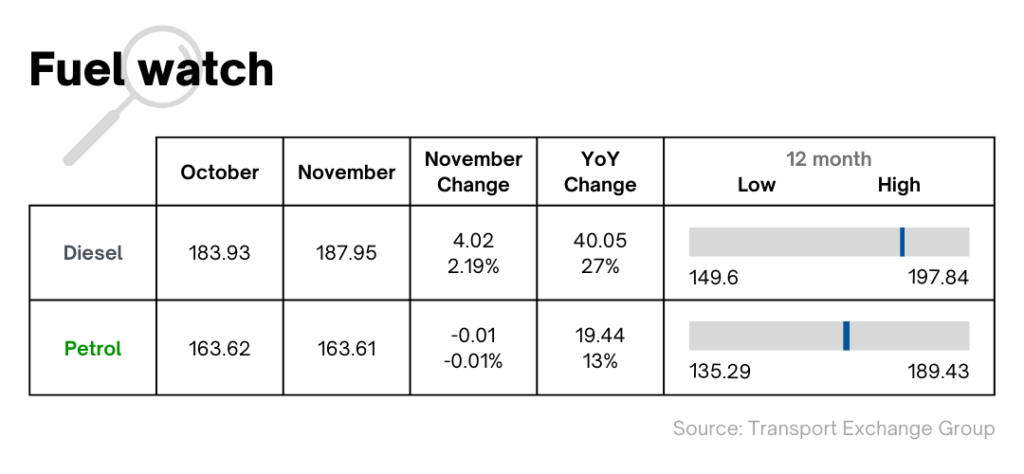

Regardless of how much demand is impacted, continuing driver shortages and high fuel prices will nonetheless push both haulage and courier prices up.

One highly relevant part of Jeremy Hunt’s autumn statement was a proposed 23% increase in fuel duty, effective from March next year. The first fuel duty rise since January 2011, it will add 12p per litre to petrol and diesel prices.

Road transport businesses already face higher energy costs in April 2023, with the Energy Bill Relief Scheme (EBRS) set to end. The potential fuel price increase will only add to their overheads.

Driver Shortages

A new report from the International Road Transport Union highlights a chronic shortage of truck, bus and coach driver shortages in Europe.

Part of the problem is the ageing profile of drivers, with 30% of drivers set to retire by 2026 and replacements coming into the sector 4-7 times slower. On current projections, the number of unfilled driver positions is set to reach 60% (or two million) by 2026.

One factor deterring potential recruits from becoming HGV drivers is inadequate conditions. Acknowledging this issue, the government has now upped its commitment to match industry funding for facilities, making its investment worth £52.5 million in total.

But that may come too late for the traditional Christmas surge in road transport demand. Coupled with driver shortages, that hike in demand will certainly push haulage and courier prices upwards.

Delivery drivers

Over a shorter distance, parcel delivery drivers are also in high demand, particularly as the festive season approaches. At the same time, the role of drivers is changing to satisfy consumers’ shifting needs – with speedy delivery coming top of the list. To retain drivers – and support them – new technology may well be required.

All this means extra costs for courier companies, which, again, will result in higher prices.

Inflation

Inflation hit a 41-year high of 11.1% in November, squeezing transport companies’ already thin profit margins. Against this backdrop, Paul Mummery of the RHA said: ““This is why we’re calling on ministers to announce a minimum 15 pence per litre fuel duty rebate for transport operators to reduce the cost of moving goods and ease inflation.”

If there is a fuel duty rise next year, more road transport operators will look to electrify their fleets, but initial investment and rising energy costs mean this alternative strategy also comes with a hefty price tag.

Due to inflationary pressures, some businesses in the supply chain may well start to cut their working days. ONS figures highlight that foodservice operators were more likely than any other sector to reduce trading by at least two days a week to minimise energy costs. The sector was also the most likely to cut trading hours each day.

It remains to be seen just how many businesses will reduce working hours, but there will certainly be knock-on effects for the road transport industry.

Demand watch

Potential cuts in working hours for road transport customers will obviously affect demand for hauliers and couriers.

More immediately, Christmas will provide a boost in demand, although retail sales are expected to be lower than in previous years. According to the ONS, UK sales figures rose 0.6% in October, after falling 1.5% in September.

Darren Morgan, director of economic statistics for the ONS, said: "Looking at the broader picture, retail sales continue their downward trend seen since summer 2021 and are below where they were pre-pandemic."

In summary

As inflation meets recession, the UK is facing a turbulent economic time.

If they’re not already doing so, road transport businesses will increasingly have to pass high energy and fuel costs on. Ongoing driver shortages add another dimension to the picture, requiring companies to consider raising wages at a time when they can least afford to do so.

Accompanied by the annual Christmas demand spike, these factors will see the price index rise during December. However, inflation-weary consumers will almost certainly spend less this festive season, so the spike might not be as steep as previous ones.

Nothing is business as usual this year, so we’ll keep a close eye on developments in the industry as they happen.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn