March ’23

5th April 2023

TEG Road Transport Price Index rebounds from two-year low with traditional spring rise

Overall price-per-mile rises slightly in March and 2.8% year-on-year, as fuel duty remains frozen, but inflation speeds up

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

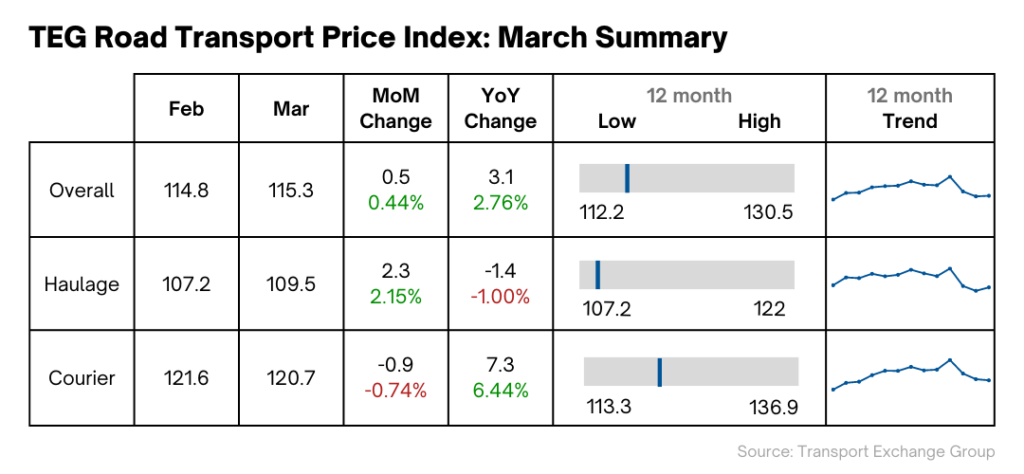

The combined price-per-mile for haulage and courier vehicles rose 0.5% during March, marking the start of the traditional spring price rise. This trend has occurred for three of the last four years (excluding 2020, when Covid-19 hit the UK).

Compared to March 2022, the index is up 2.8%, driven by strong year-on-year growth of 6.4% for courier prices. By contrast, haulage prices are down 1% on 2022 levels, although they increased by almost 2.2% during March.

Industry pulse

Jeremy Hunt’s much-anticipated Spring Budget both helped and hindered the road transport industry.

There was relief that fuel duty was kept frozen for another year, and HGVs were exempted from a vehicle excise duty rise. At the same time, however, the government announced the return of the HGV levy in August this year. Plus, there was no support for electric vehicle adoption in the budget.

In the wake of the budget, the chairman of the Office for Budget Responsibility said that Brexit meant GDP was 4% smaller than it would’ve been. March also saw UK inflation rising 4.4% faster than in the Eurozone. All of this points to more tough economic times ahead and, potentially, road transport prices increasing further, in line with inflation.

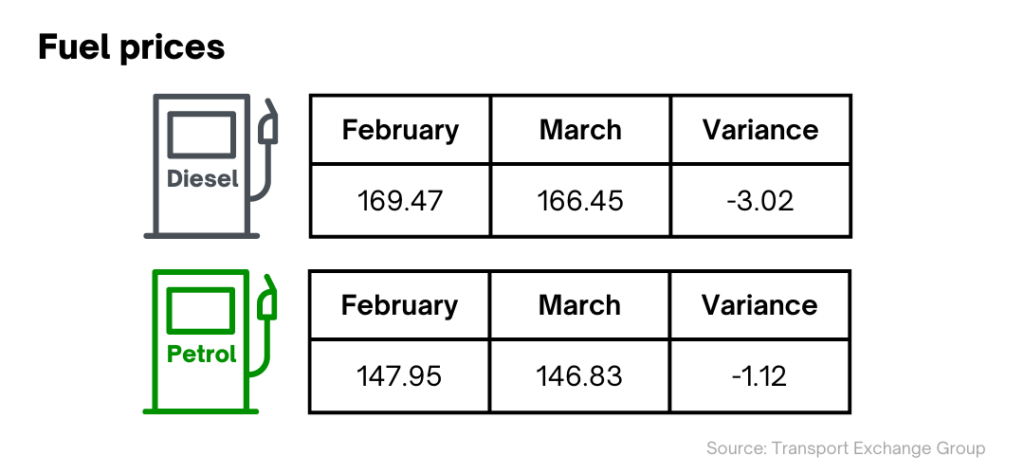

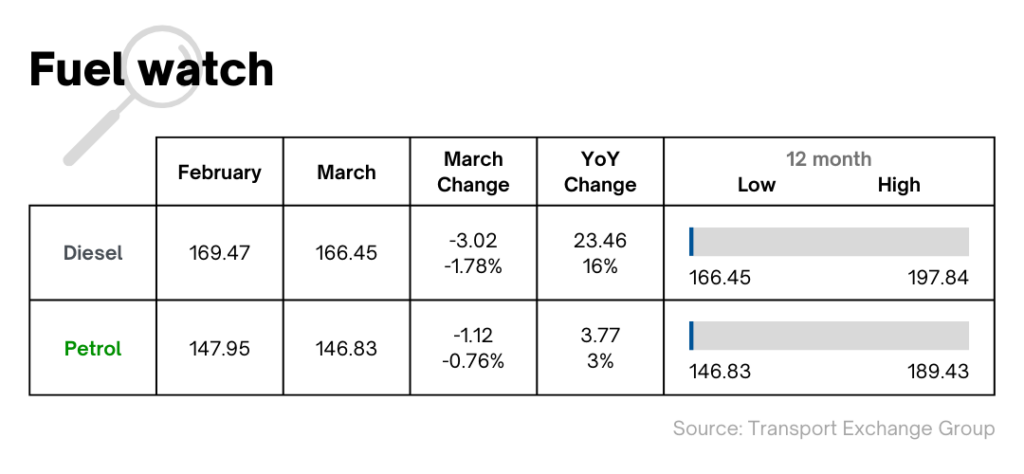

Although March saw neither diesel or unleaded prices fall dramatically, average diesel prices actually dropped by more than unleaded: by 2.28p compared to 0.8p. The difference in price between diesel and unleaded remains around 17p[1] , despite a smaller gap than that in wholesale prices. But this figure has also dropped by 5p in the last month, bringing diesel-unleaded parity a step closer.

Costco recently bucked the trend among retailers, cutting 4p off diesel at its sites across the UK. Their move raised hopes that other retailers will follow suit, which would also allow hauliers and couriers to factor a drop into their own prices.

Both couriers and hauliers will be hoping the trend continues, which might allow them to bring their prices down – or at least enjoy a larger profit margin.

Spring Budget

For the road transport industry, the headline of the Spring Budget was the fuel duty freeze. Excise duties were also kept at current levels for HGVs. At a time when costs are spiralling elsewhere, these two developments provided some relief and represent not-insignificant savings. Yet, the budget wasn’t all good news for the industry.

The return of the HGV levy was a blow to operators. A restructured levy will come into force in August, which will encourage companies to use newer vehicles and gain a 10% discount on the amount they pay.

But Declan Pang, Road Haulage Association Director of Public Affairs & Policy, says: “We are also concerned that the focus of the HGV levy has been shifted towards CO2 emissions…given the progress the industry has already made in reducing emissions.”

EVs ignored

Many in the industry had hoped that the budget would provide more support and incentives for businesses (and individuals) running electric vehicles (EVs). As it turned out, the budget bypassed the topic of EVs.

For those road transport operators using EVs, there is one particular issue that sticks in the craw. When drivers charge using public charging points, they pay 20% VAT, compared to just 5% paid by people charging vehicles at home. Of course, haulage and courier drivers rely upon public charging points when they’re delivering goods up and down the country.

Availability of such charging points is another problem altogether – one that the budget also overlooked. According to one commentator, the budget “sabotaged” EV adoption hopes.

Overall, the budget provided some short-term comfort for road transport operators, without giving them the kind of longer-term support they were looking for. As a result, Jeremy Hunt’s plans won’t have convinced many freight companies that they can drop their prices just yet.

Costs climbing again

Another part of the budget that operators paid close attention to was the upcoming increase in corporation tax.

Although energy costs are now significantly lower than they were following Russia’s invasion of Ukraine, they remain high. There is also ongoing pressure from employees to increase wages as cost-of-living rises continue to bite. And with the latest inflation figures coming in at 10.6%, a rise in corporation tax will have many road transport companies thinking about tightening their belts.

Brexit holding Britain back

Richard Hughes, Chairman of the Office for Budget Responsibility recently said that Britain’s GDP would be 4% larger if the country was still in the EU. He put Brexit on a par with Covid-19 and the energy crisis as a leading cause of economic damage.

Hughes also warned that it would be five years before consumer spending power rebounded to levels seen before the pandemic. Of course, people will also want to see lower levels of inflation before consumer confidence picks up in any meaningful way.

Overall, the UK’s economic outlook is still far from stable and remains difficult to predict. And against that backdrop, road freight companies will face some uncertainty in the coming months.

In summary

The Spring Budget answered some questions that the industry had been asking for a while. Chief among them was whether fuel duty would be increased or remain frozen.

But it also threw up some surprises, with a notable lack of support for EVs. There was also an unforeseen rise in inflation and a hike in corporation tax, which all gives road transport companies plenty to consider.

If the index follows the pattern of previous years, we can expect steady price increases from now until at least summertime. But there are so many variables at work that even operators might not be sure about their pricing strategies right now.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn