December ’22

9th January 2023

TEG Road Transport Price Index shows record level for courier vehicles as Christmas pushes prices up

Both courier and haulage prices rose significantly in December, meaning a 6.9-point increase for the overall index – even as fuel costs drop

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

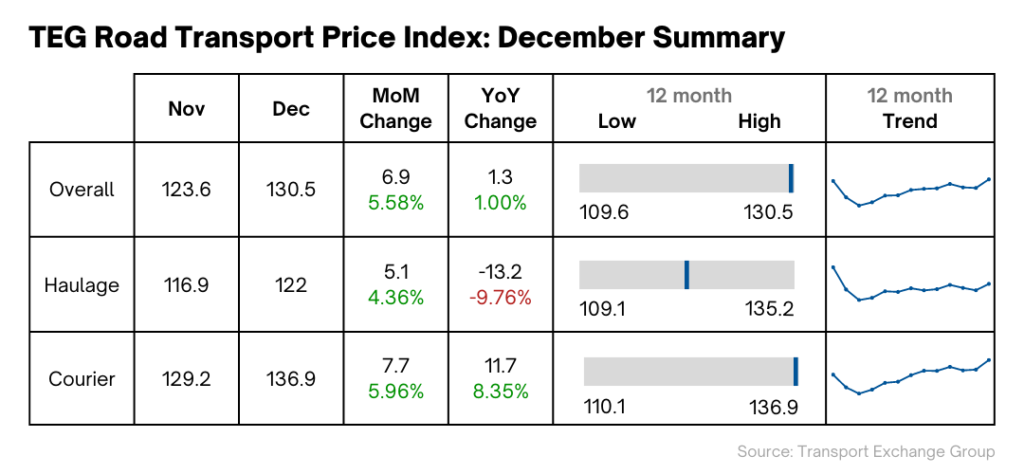

According to the latest TEG Price Index data, the average price-per-mile for haulage and courier vehicles climbed significantly – by 6.9 points – in December.

This 6.9-point price hike is very much in line with previous years. And with a 1.3-point year-on-year increase, the index has surpassed its December 2021 level.

The Courier Price Index continues to track above the overall index, with a 7.7-point increase from November and a huge 11.7-point YoY rise. It’s now at its highest level since the index began in January 2019.

Haulage still sits behind the overall index at 122, declining 13.2 points YoY, although there’s been an uplift of 5.1 points on November figures.

Industry pulse

As ever, there are various factors pushing and pulling at road freight prices, many of which have been at play for many months. Brexit issues and driver shortages are proving more stubborn than some thought they would, while fuel costs and inflation continue to have a huge impact.

However, the main difference between November’s index and December’s index is undoubtedly Christmas demand. Right now, at least, this traditional hike in demand is the dominant factor affecting the road freight industry – and the prices freight firms charge.

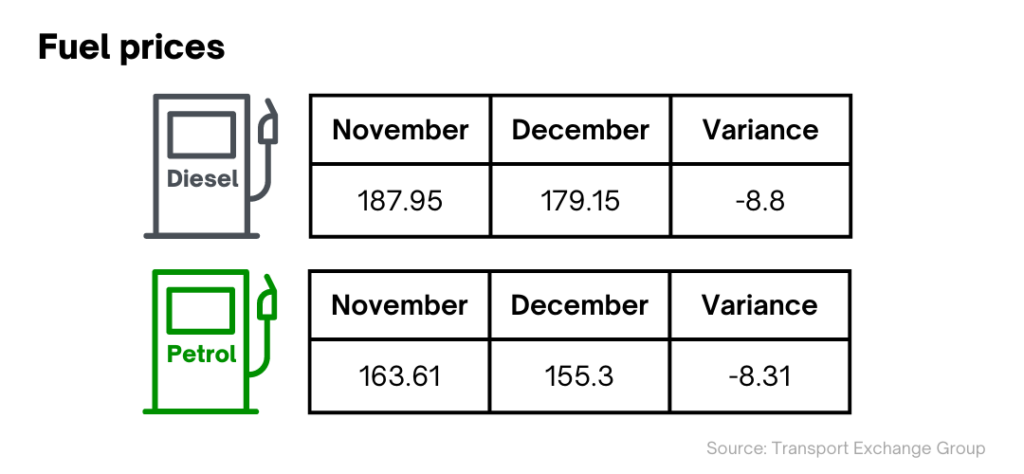

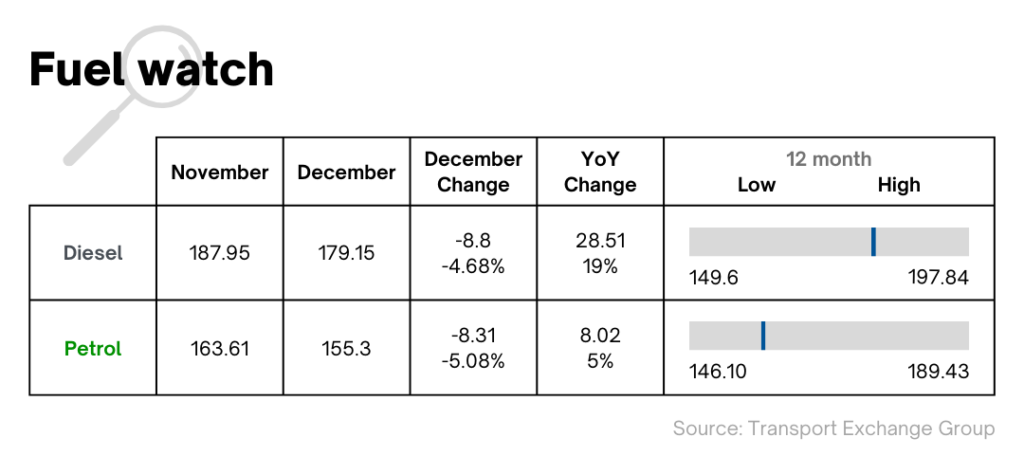

2022 was a turbulent year for fuel prices, with plenty of twists and turns impacting both wholesale and forecourt prices. Ongoing Covid-19 aftereffects, the Russian invasion of Ukraine and decisions taken by OPEC have all contributed to forcing the price of oil up and up. Brent crude hit an all-time high of $122 a barrel in June, resulting in diesel breaking through the £2 barrier at UK pumps.

Although prices have now come down from those levels, the current prices are still a record high for the festive season. And the threat of a 23% hike in fuel duty in March 2023 looms large.

Nonetheless, businesses everywhere – and particularly those in road transport – will be hoping for more stability in fuel prices in the coming 12 months Of course, they’ll also be hoping for lower fuel costs – as will the customers they’re forced to pass price rises on to.

Ongoing HGV driver shortages

It seems HGV drivers are finally being heard in their struggle to gain better working conditions and pay.

Freight transportation services provider XPO, for instance, met its goal of hiring at least 1,000 truck drivers in the UK and Ireland during 2022. Lynn Brown, XPO’s human resources director – UK and Ireland, said: “It is critical that we support our drivers by understanding their needs. We offer competitive salary and benefits packages, hold forums to encourage driver feedback, and provide upskill training…”

With companies now responding to drivers’ requirements more effectively, staffing issues are now shifting to the public sector. Nearly two-thirds of English local councils said they have found it, or expect to find it, difficult to recruit and train HGV drivers for ‘winter resilience activities’ like gritting the roads. Drivers, it seems, are choosing the more attractive proposition of working in the private sector.

Despite all this, there’s still a shortage of HGV drivers in the UK. While Paul Mummery of the RHA highlights a major barrier to retaining drivers – inadequate working conditions: “We believe there’s a shortage of 11,000 lorry parking spaces, forcing truckers to park in lay-bys and industrial estates without access to food, toilets and showers."

The industry – and the government – must invest in both facilities and salaries. And that money must come from somewhere, meaning more pressure on road freight companies to increase their prices.

Fluctuating inflation

UK inflation sprung a surprise in November, falling slightly by 0.4% to 10.7%. While there’s unlikely to be a rapid fall in inflation and the cost of living remains high, it’s encouraging to see inflation moving in the right direction. The Bank of England has said it expects that rapid fall to come in the middle of next year and is targeting an inflationary rate of 2% in two years’ time.

Until then, the industry is still under pressure to support employees with the cost of living, with wage rises an ever-present issue to be addressed.

Brexit troubles continue

The British Chambers of Commerce recently commissioned a report to mark two years of the EU-UK Trade and Cooperation Agreement. It found that over three-quarters (77%) of companies affected by the agreement said it wasn’t helping them increase sales. Plus, more than half (56%) of the respondents cited difficulties with the new trading rules.

Hilary Benn MP, who co-convenes the UK Trade and Business Commission, said: “Since Brexit, British businesses have been saddled with new red tape, costs and bureaucratic customs checks.”

Demand watch

According to the Global Last Mile Delivery Market Report 2023-2027, the worldwide last-mile delivery market is projected to grow by $165.6 billion during that period.

One of the main factors driving this expansion is technology. Consumers are pushing for faster, more flexible deliveries and an improved ability to track deliveries. To satisfy these needs, tech giants are becoming increasingly involved in the last-mile market, bringing innovations like drones and automated vehicles – and more investment. Both the courier and haulage industries can grow with this demand.

More immediately, the Christmas period brought its customary boost in demand. The Shopping for Christmas Report: 2002 found that a slight majority (51%) of all Christmas shopping will be done online this year, representing millions of parcels travelling up and down the UK’s roads. Bearing this in mind, it’s no surprise that courier prices have reached a record high this month.

In summary

As anticipated, we rounded 2022 off with the sharp rise in prices that always accompanies Christmas. Falling fuel costs and inflation have undoubtedly tempered this increase, but neither fuel prices nor the cost of living can be counted on to remain stable.

One thing that is certain is a post-Christmas slump in both haulage and courier prices. It remains to be seen how dramatic that slump is, but with the cost of living crisis continuing, it is expected that consumer spending will drop significantly in January.

At the same time, road freight businesses will face their own rising costs, as well as pressure to boost pay for in-demand drivers and the prospect of a fuel duty hike in March. Although the UK government may yet opt to help the freight industry with a support package, British transportation companies remain vulnerable to the actions taken by large energy-producing countries such as Russia, Saudi Arabia and the U.S.

This all makes it difficult to predict what 2023 will look like for the industry, so we’ll endeavour to provide you with a greater understanding of developments as they happen.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn