November 2021

30th November 2021

TEG Road Transport Price Index falls by 1.6 points in November

Road freight prices dropped as the Christmas period approaches, but previous years’ data suggest a spike is expected in December.

The latest data from the TEG Road Transport Price Index reveals that the average price-per-mile has fallen 3.3 points since a record-high peak in September.

November Key Findings:

Month-on-month, there’s been a 1.6-point decrease in what carriers are charging per mile, for both haulage and courier vehicles.

However, looking at the state of the market in November 2020, the index reveals a 23.1 point year-on-year increase, reflecting the surge in demand when the country opened up after lockdown.

The price-per-mile average still remains at its third-highest point since January 2019, powered by the unprecedented demand for drivers in the wake of Brexit and the pandemic.

Trends for haulage and courier vehicle costs in November 2021 are following a similar pattern to the previous two years. The average price dipped by 2.3 points between September and November 2019, and by 0.3 points between September and November 2020.

December 2019 and 2020 showed 5.1 and 7.1 point month-on-month spikes, suggesting another surge will come in December 2021 as the busy festive period begins.

In November the price-per-mile for haulage vehicles was 11.1 points higher than that of courier vehicles – continuing a seven-month run of haulage vehicle inflation exceeding courier vehicle inflation since first overtaking them in April.

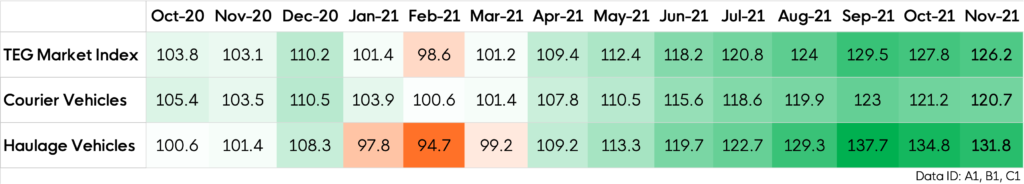

Price-per-mile changes over the last 14 months

Who’s being impacted?

High-street retailers

With many high-street names already floundering, the shortage of HGV drivers and the subsequent supply chain disruptions are set to hit retailers throughout the bustling Christmas period. They’ll face higher costs for haulage and courier services, which will cut into their profits. They would’ve been hoping for a much more positive festive season after suffering during last year’s Christmas lockdown, but many are already bracing themselves for another disappointing sales period.

There are signs that consumers are all too aware of supply chain pressures – exasperated by high demand – with nerves driving consumer behaviour. Research from the Post Office shows that two-fifths of people started Christmas shopping early because of concerns over goods shortages, delays and long queues.

Ecommerce businesses and consumers

It’s not just high-street retailers suffering: ecommerce businesses will be paying more for deliveries, impacting their profits. There could also be knock-on costs for consumers here, who are already facing less choice than usual, particularly in terms of food and drink. Worryingly for parents, toys may be another commodity in shorter supply than normal.

Amid all this uncertainty, small firms will be hit especially hard as they struggle to compete with larger names.

Farmers

Farmers, many of whom are already working with tight profit margins, are having to increase their prices to stay afloat, passing on rising supply chain costs to consumers. As Christmas approaches and people stock up on food, the public is sure to notice the difference.

The Roads sector

Supply chain issues have meant the roads sector has had to turn to imported materials to meet demand. With costs rising by as much as 20%, a sector already impacted by Brexit is set to suffer further issues.

How is the logistics industry bouncing back?

The logistics sector has worked hard to retain and recruit drivers to satisfy the extremely high levels of demand, with results starting to be seen.

In late November, the Road Haulage Association announced that the UK driver shortfall had dropped by approximately 15,000 drivers over the past six months. In addition, figures from the Office for National Statistics show the number of HGV drivers in the UK grew by 30,000 in this year’s third quarter. However, around 9,000 under the age of 45 left the industry during the same period.

Government measures have also been introduced in an attempt to ease the crisis. To get more drivers on the road, the number of HGV driving tests available has been increased, while the government has also opened a temporary visa scheme for HGV drivers.

“Despite a small monthly drop in the price per mile, the overall average in November is still one of the highest since the beginning of 2019. The impacts of this are being felt across multiple sectors, and there are worries of noticeable consumer impact as we approach Christmas.

Lyall Cresswell, CEO of Transport Exchange Group

The road freight industry must continue to push for better recruitment and retention of drivers, and collaborate with other sectors to minimise the pressures over the festive season”

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn