June ’22

7th July 2022

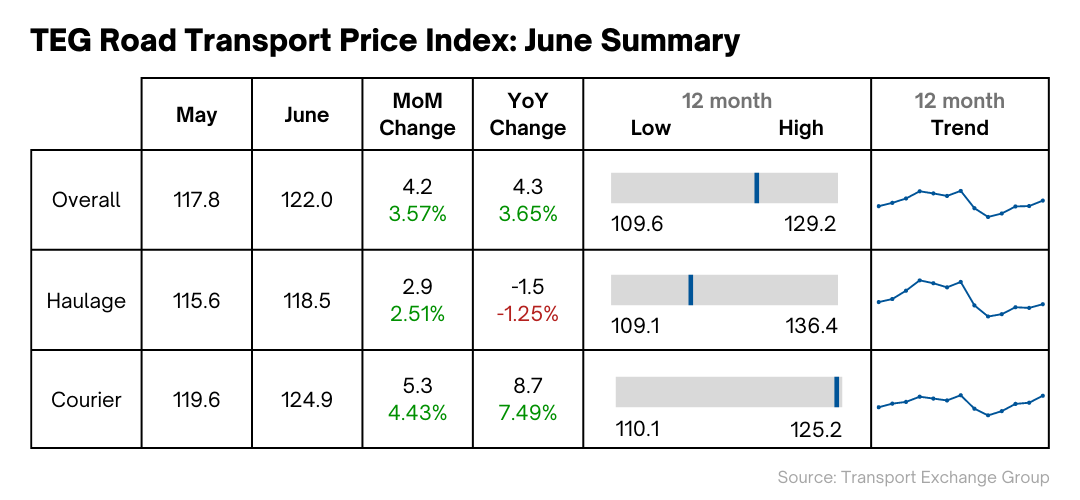

Market moves: TEG Price Index up by 4.2 points, driven by strong courier demand

As UK inflation surges, the average price-per-mile for haulage is now lower than in July 2021, but the courier price is up 8.7 points, year-on-year.

TEG Price Index data from June shows the average price-per-mile for haulage and courier vehicles rose 4.2 points over the last month.

Integra makes sense of the road transport landscape.

Trends at a glance

Since last June, the overall index has gone up 4.3 points, with an increase of 6.5 points from the first quarter of 2022 to the second quarter.

However, this growth is currently one-sided: courier prices are tracking above the overall index, increasing 5.3 points since May and a huge 8.7 points up on this time last year.

By contrast, haulage prices experienced more modest monthly growth of 2.9 points and are now 1.5 points lower than in June 2021.

What’s pushing prices up?

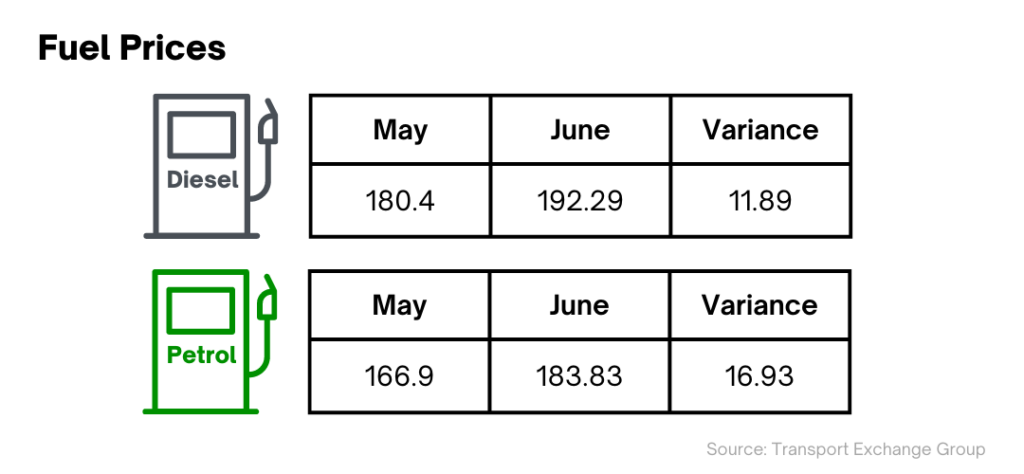

Average fuel prices continue to rise, with diesel up 11.89p compared to May, according to the Department for Business, Energy & Industrial Strategy. Add to this supply and capacity disruptions, rising business costs and the war in Ukraine, and it’s easy to see why road freight prices are at record levels.

Companies have two choices: reduce controllable costs such as pay rates or pass the increases on. The rises in the price index indicate that cost hikes are being passed on.

Industry pulse

The price of fuel and runaway inflation are not only pushing costs up – they’re also making the case for greener vehicles and greener operating models (such as matching loads to empty vehicles in real time) more pressing. Fleets can’t go electric overnight though, and meanwhile, demand for courier vehicles continues unabated and supply chains are still stretched.

Reflecting this strain – and with shipping becoming less cost-effective – many companies are holding more goods in storage. Leading the way are ecommerce brands, with Amazon alone occupying a quarter of all warehouse space leased in 2020 and 2021. [1]

Fuel watch

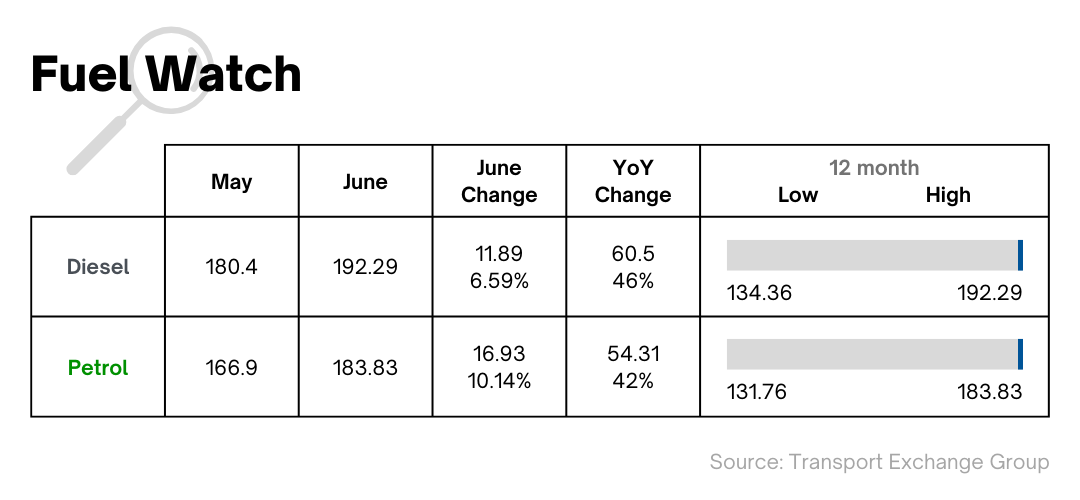

June has seen petrol and diesel prices reach record highs, despite attempts to curtail its rise. Fuel retailers are blaming surging wholesale prices for the effect on consumers, claiming that oil refineries are not passing on a fall in the price of crude oil, which leapt as Russia invaded Ukraine in late February.

Looking at fuel prices in the first half of 2021, the difference between wholesale and pump prices was, on average, 31.69p. In 2022, the gap has been more pronounced at 35.76, some 13% more than last year, lending weight to retailers’ argument.

The gap has caused Business Secretary Kwasi Kwarteng to order an urgent Competition and Markets Authority (CMA) review of the fuel market, along with a long-term study under the Enterprise Act 2002.

The industry is asking for an essential user rebate, which would cut fuel costs for hauliers, and ultimately help reduce costs for consumers. The RHA welcomes the CMA investigation into fuel prices, arguing that the UK government should follow the example of Germany by cutting fuel costs for essential users, including hauliers.

In the meantime, Integra can help you get a handle on what market-relevant pricing looks like.

Vehicle watch

According to the Society of Motor Manufacturers and Traders (SMMT), commercial vehicles have reached a record share of vehicles on the road: one in eight. Car ownership fell again last year, the first consecutive decrease in more than 100 years. Meanwhile, articulated truck numbers are up, and rigid vehicle registrations are down. But does this increase of commercial vehicles hitting our roads indicate there’s an end in sight to the staff shortages – and what does it mean for emissions?

HGVs and LCVs comprise just 13% of all vehicles on the UK’s roads. However, they carry 90% of the total weight of goods transported in the UK for the industrial, commercial and consumer sectors. Given their significant power requirements, they account for around 35% of CO2 road transport emissions.

While today’s vehicles emit lower levels of carbon than ever before, manufacturers are committed to going even further. They’re introducing alternative fuels, as well as electric and fuel cell technologies that will, over time, reduce tailpipe emissions to zero.

Market penetration of alternatively fuelled powertrains – including gas, biofuels and hydrotreated vegetable oil (HVO), as well as zero emission electric and fuel cell HGVs – is currently around 14 years behind that of cars. Yet the government plans to end sales of all new non-zero-emission HGVs by 2040, only 10 years behind the same measure for cars. Somewhere along the line, this gap must be reduced.

Are longer heavier vehicles the answer?

The government is currently on the lookout for operators interested in taking part in its latest trial: longer heavier vehicles (LHVs) up to 25.25m in length and 60 tonnes gross vehicle weight.

The RHA welcomed the move this week and has called on its members to complete the associated survey. In a statement, the RHA said:

“A key element of the high-capacity lorries is the ability to carry up to 50% more pallets than a standard large lorry combination – resulting in significant carbon savings.”

Moves such as these are inevitable, but it remains to be seen what the medium-term impacts on the industry will be. While there will be cost savings in some areas, initial costs will be an important consideration. As proposals become clearer, we can expect them to influence the price index more and more.

Ecommerce & delivery expectations

The UK has an advanced ecommerce market, even when compared to other countries in Europe, with consumers expecting flexible deliveries as a given. Pre-pandemic e-commerce sales in the UK were just 19% of total sales, rising to a huge 27% share in January 2022.

This shift in buying behaviour brought on by the pandemic produced shockwaves throughout the distribution network, with carriers still trying to keep up with capacity demands. The rise of rapid delivery services has led to pressures moving upstream, requiring businesses to have products in stock and get them to end users in record time. Coupled with increasing business costs, this surge in demand is pushing courier firms’ price-per-mile up and up.

The B2B world has equally high expectations, so carriers must often deliver an extra trailer or add an extra 7.5t truck to the daily collection: to deal with an increase in smaller, more frequent orders[1] [2] . Our data shows that spot market bookings of 7.5t trucks are up 20%, year-on-year. This is where Integra can help, matching supply and demand so that carriers can accept such increases and use the Integra marketplace to outsource this extra capacity.

In summary

It seems the low price-per-mile levels of early 2021 are now behind us, with figures increasing since March. Records from previous years indicate that the index will continue to rise in the third quarter of the year and may peak in September, pushed upwards by inflationary pressures.

Of course, much will depend upon the various factors at play, including geopolitics, fuel prices and, potentially, more government intervention in the industry. We’ll keep a close eye on all the relevant trends and developments, before our next report at the beginning of August.

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn