February ’23

6th March 2023

TEG Road Transport Price Index shows haulage prices at lowest level for almost two years

Courier prices also fall by 4.5 points, but record 10% year-on-year increase – with prospect of Brexit relief around the corner

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

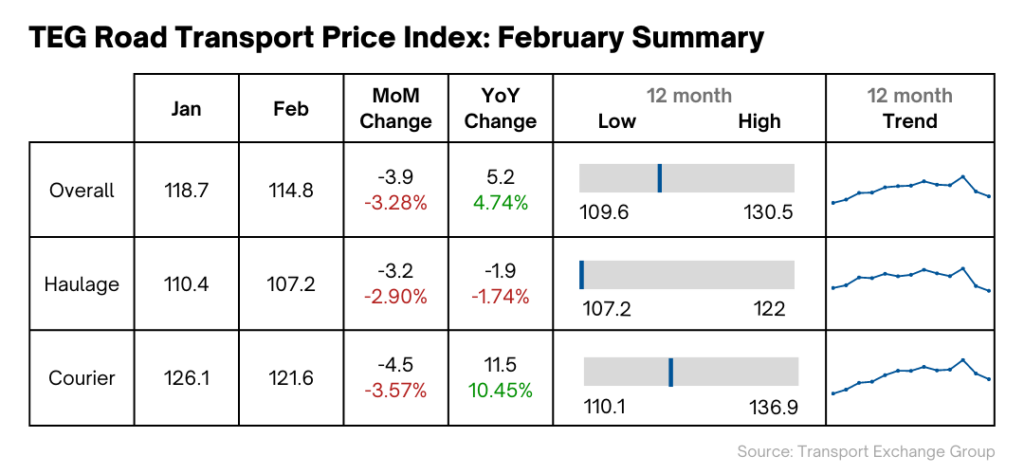

Falling by almost 4 points last month, the average price-per-mile for haulage and courier vehicles followed the February trend of previous years.

Although courier prices dropped by more than haulage prices (4.5 points compared to 3.2 points), February figures saw the haulage price-per-mile reach its lowest point in almost two years.

Despite the recent dip, courier prices are still up by more than 10%, year-on-year. Their rise is powering the overall year-on-year index increase, with the index finishing February 5.2 points higher than it did last year.

Industry pulse

The end of February saw some notable economic and political developments in the UK, which will impact the road transport industry for months to come.

Of course, the Windsor Framework dominated headlines. Hauliers, couriers and all manner of road transport businesses will be expecting more relaxed border controls to speed up some journeys. But they’ll also be hoping reduced bureaucracy can boost the UK economy in general.

The agreement comes as supply chains have again come under scrutiny, with many fresh vegetables going missing from UK supermarket shelves. It remains to be seen whether demand for transportation is significantly affected by supermarket scarcities.

One reason for the shortages is the effect of energy costs on the farming industry. But European natural gas prices dropped to an 18-month low in February, leading some commentators to predict an improving economic outlook for the UK and EU.

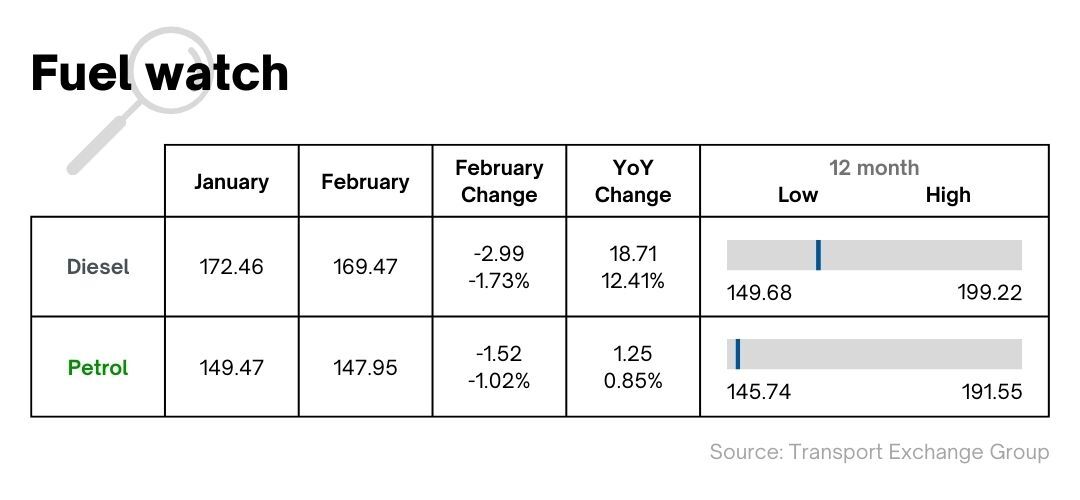

Diesel prices fell by a little more than petrol prices in February. However, there’s still a huge discrepancy between wholesale and retail prices for diesel. Wholesale diesel prices were just 6p more at the end of February, but the retail price is some 22p more expensive. In the last year, diesel prices have risen by 12%.

Costco recently bucked the trend among retailers, cutting 4p off diesel at its sites across the UK. Their move raised hopes that other retailers will follow suit, which would also allow hauliers and couriers to factor a drop into their own prices.

RAC fuel spokesman Simon Williams said: “For nearly a month, the gap between wholesale petrol and diesel prices has been less than 10p a litre and in recent days, it has reduced to just 3.5p, yet average diesel prices at the pumps remain stubbornly high having fallen by only 2p since the start of February.”

The Windsor Framework

For more than three years, the shadow of Brexit has been hanging over the road transport industry. As well as constant uncertainty, increased costs and bureaucracy have caused great damage to the sector, in addition to stoking the ongoing driver shortage.

Although the Windsor Framework agreed between the UK and EU doesn’t completely solve any of these problems, it’s certainly good news for operators going to and from Northern Ireland.

Plus, businesses will also be hoping that the agreement signals the start of a rapprochement between the UK and the EU. Fundamentally, more cordial relations with the world’s largest trading bloc can only benefit the UK economy. And with the threat of a trade war seemingly gone and the promise of smoother border processes ahead, investing in UK businesses will now be a more attractive prospect.

For the road transport industry, this could mean increased demand to accompany falling costs, potentially driving the price-per-mile beyond last year’s record highs.

Falling energy prices

But it’s not just improving UK/EU relations bringing business costs down.

With Europe experiencing a mild winter and coming together politically to wean itself off Russian energy, gas prices across the continent fell by up to 85% since August 2022.

Although energy costs remain high for businesses right now, the drop in gas prices has created hopes that the EU and the UK can avoid a deep recession. The European Commission says the price dip – in conjunction with government and consumer spending – has boosted the EU’s short-term economic outlook.

Sustainability surge

Even if energy prices continue to decrease and global economies fare better than previously forecasted, the Russian war on Ukraine will still have had a profound effect on Europe: it woke the continent up to its dependency on Russian energy. As a result, the momentum behind renewable energy now appears unstoppable.

Against this backdrop, the European Commission recently published objectives for reductions in lorry and bus emissions. Compared to 2019 CO2 levels, the EU wants to reduce average emissions by:

- 45% by 1 January 2030

- 65% by 1 January 2035

- 90% by 1 January 2040

In the UK, the Transport Decarbonisation Plan is aiming for net zero emissions across all transportation by 2050. To achieve such targets, road transport companies across Europe will obviously need to embrace electric vehicles. While this will mean significant initial outlays for firms, running costs will inevitably be cheaper than diesel vehicles.

Clean air zones

To push emission cuts and greater sustainability, an increasing number of UK cities are introducing clean air zones. Sheffield is the latest city to do so, taking the total up to seven, with Manchester’s plans under review.

As more cities join the clean air revolution, costs will, of course, rise for road transport firms. They can either opt to pay the charges, or skirt around cities, lengthening delivery times and incurring greater fuel costs. Alternatively, they can invest in more environmentally-friendly fleets. Then companies will have to choose to absorb these costs or pass them on to customers.

There’s no doubt that the appetite for low and zero-emission vehicles is growing. However, according to Mike Hawes – Society of Motor Manufacturers and Traders chief executive – operators need to see more from the government before they invest heavily in such vehicles. In particular, he says the UK needs clearer plans on electric HGV charging infrastructure:

“As manufacturers deliver more zero emission vehicles to market, there must be policy certainty and infrastructure assurance to inspire further fleet renewal. This will be essential to the UK’s ability to deliver its decarbonisation agenda, while keeping the British economy and society on the move.”

Demand watch

Before the government can get a handle on the shortage of fresh vegetables in supermarkets, the situation might cause a dip in demand (and the price-per-mile) for road transport. National Farmers Union president Minette Batters recently said that production of salad ingredients was expected to be lower than at any time since 1985 (when records began). She called for more government support for farmers cultivating salad ingredients.

Undoubtedly influenced by that shortage in some part, UK grocery prices hit an all-time high of 17.1% in February. This will cause consumers to be thriftier when food shopping, hitting demand for both haulage and courier vehicles delivering food.

In more positive news, there is significant optimism about what the Windsor Framework might mean for the UK/EU relationship. If it can remove some of the shackles placed on trade and the economy by Brexit, we may see greater economic growth than forecast just weeks ago. Such a scenario will undoubtedly increase demand for haulage and courier services, pushing the price-per-mile upwards.

In summary

The Windsor Framework could provide serious relief to the industry if it can banish some of the uncertainty surrounding Brexit. What’s more, it could also lift the UK economy generally, pushing growth in the right direction and thereby inspiring greater demand for road transport services. Decreasing energy costs should also stimulate the economy, at the same time as they reduce costs for individual businesses.

With the need for more sustainable fleets becoming more and more pressing, firms will certainly welcome any cuts in energy costs. Electricity bill hikes will have hurt many companies who invested in cleaner vehicles – a trend they’ll now hope is coming to an end.

Especially at the moment, however, the sector is subject to much larger influences than that. As supply chain issues emerge once again and the UK’s post-Brexit landscape unfolds, the industry will have to weather some turbulence in the next few months.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn