April ’23 – Road Transport Price Index

3rd May 2023

Haulage prices picking up pace

TEG Road Transport Price Index haulage prices are up 3.6% in last month and overall price-per-mile hits April record, as double-digit inflation remains, and interest rates set to increase for 12th month in a row

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

TEG Road Transport Price Index - Trends at a glance

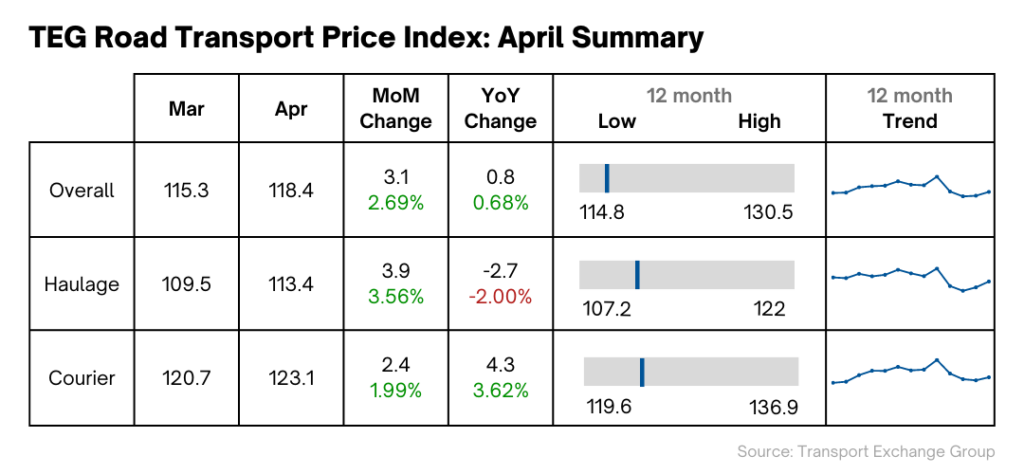

Jumping 2.7% during April, the combined price-per-mile for haulage and courier vehicles reached its highest-ever level for April. Bolstered by a strong month-on-month haulage increase, these figures mark the beginning of a traditional spring price rise.

Nonetheless, haulage prices are down by 2% from last year’s level. By contrast, courier prices are up by 3.6%, resulting in a stable overall price, year-on-year.

Industry pulse

Recent analysis revealed that the UK economy is losing £12 billion a year to supply chain issues. Amid ongoing Brexit penalties, new projections forecast that the UK economy will shrink this year and perform worse than any other G7 nation.

At the same time, road transport firms must contend with a hike in corporation tax, inflationary business pressures and continued driver shortages.

The slow-burning shift towards greener fleets rumbles on and despite a new government forum on decarbonisation, insufficient charging infrastructure is holding progress back.

In the meantime, however, some relief has come from diesel price changes.

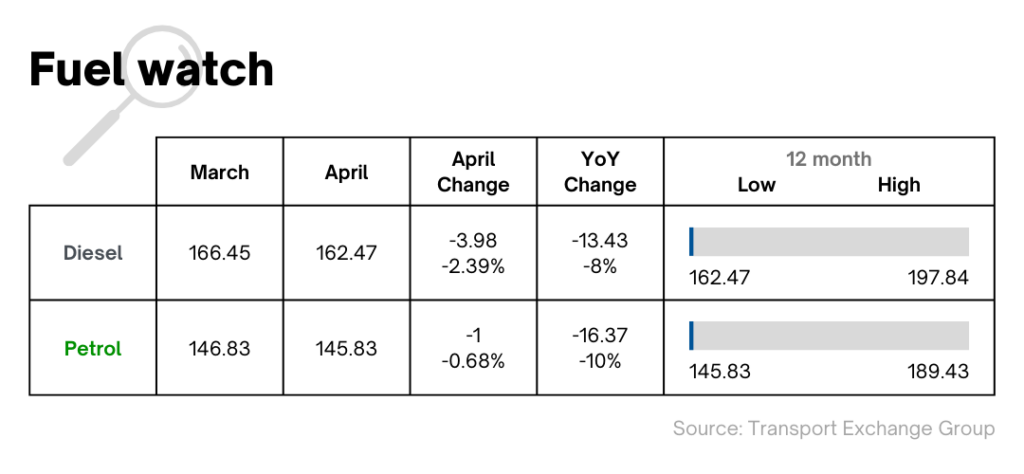

Diesel prices in the UK are higher than in all but two EU nations: Finland and Sweden. At 132p per litre, the prices in Portugal are a full 30p lower than those in the UK.

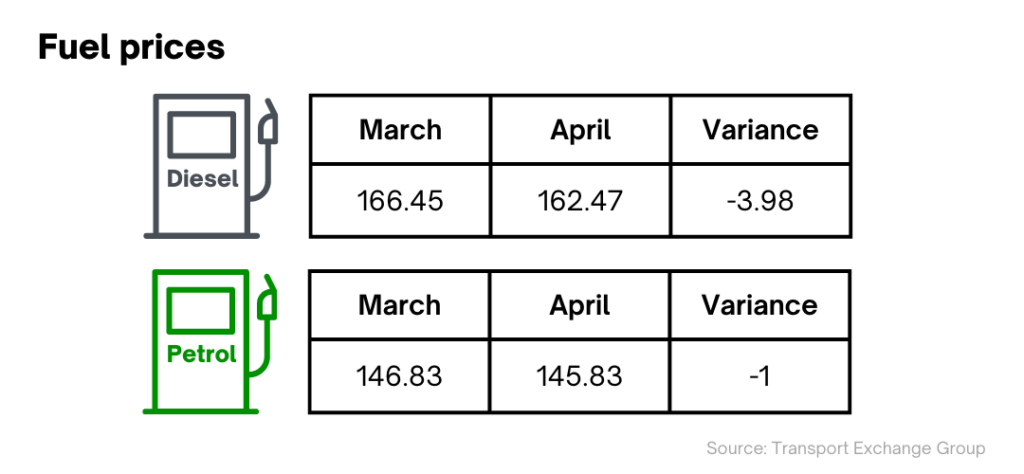

But UK diesel prices did fall by over 2% during April. And there was more good news for road transport firms: the marked disparity between diesel and petrol prices closed further, with diesel prices dropping over three times as fast as petrol prices.

However, the gap between diesel and petrol is still 17p. In fact, Sweden is the only other country in the combined EU/UK area where diesel is more expensive than petrol.

Since diesel is the lifeblood of the industry, savings made at the pumps can quickly add up. Road transport companies will be hoping the UK’s diesel price drop continues. This can mean either money to invest elsewhere, or, at the very least, less pressure to push their own prices up.

The economic climate

There are several factors affecting the UK’s economy and causing it to lag behind its G7 counterparts. The obvious one is its persistent inflation.

Stubbornly remaining in double figures at 10.1%, UK inflation is higher than anywhere else in Western Europe. It compares unfavourably with the US rate of 5% and the eurozone average of 6.9%. That eurozone average is pushed up by Eastern European nations. The EU countries performing worst are Hungary at 25.6%, Latvia at 17.2%, and Czechia at 16.5%.

Nonetheless, the Bank of England recently said it predicts UK inflation to fall sharply this year. "Wholesale gas prices are 60% down on a year ago, while the price of oil is down by 30%, which should drive a further moderation in inflation over the coming months," said Yael Selfin, KPMG UK’s chief economist.

To help this inflation drop materialise, the Bank of England is expected to raise interest rates for the 12th time in a row next month, by 0.25 percentage points to 4.5%.

The UK’s stunted growth is also being caused by workplace factors. Analysis from the Institute for Public Policy Research recently found that long-term sickness is costing the UK economy £43 billion a year. At the same time, the rate of workforce participation in the UK still hasn’t bounced back from the pandemic. Only 8 countries among the 38 members of the Organisation for Economic Co-operation and Development are in this position.

This is a problem for road freight operators in need of drivers, who are already facing Brexit-related problems when they look to foreign drivers to fill vacancies. Allied with inflation, the driver shortage only adds pressure on road freight companies to offer drivers and others pay rises. Of course, this could prompt them to raise their own prices.

The government is keenly aware of driver shortages and is trying to ease the crisis with reforms that get drivers on the road sooner.

Supply chain worries

As well as hampering efforts to hire new drivers, Brexit is hitting the supply chain. According to new research from the International Monetary Fund, some 80% of EU businesses highlight Brexit as the biggest supply chain disruptor. A recent shortage of peppers in supermarkets brought this back into the national consciousness.

The IMF report revealed that economic growth in both the UK and EU suffered due to supply chain issues. However, UK GDP growth in 2021 could have been 6% higher without them, compared to a 2% increase in the eurozone.

Availability of such charging points is another problem altogether – one that the budget also overlooked. According to one commentator, the budget “sabotaged” EV adoption hopes.

This suggests that if supply chain worries can somehow be eased, the UK could benefit from much greater growth. Individual businesses will also benefit from reduced costs. As always, the industry will be watching closely for any government measures.

Sustainability spotlight

Many in the road transport industry had hoped the Spring Budget would deliver a boost for electric vehicles. Yet, Jeremy Hunt’s plans made no mention of EVs, leading some industry figures to speak out. In particular, they deemed the current charging infrastructure to be insufficient.

Mike Hawes, Chief Executive of the Society of Motor Manufacturers and Traders, said: “A successful transition requires a long-term plan to drive the rollout of a dedicated, UK-wide HGV charging and fuelling network, combined with world-leading incentives to encourage uptake and attract model allocation – a plan that will keep a greener Britain on the move and globally competitive.”

As it stands, just one in 600 trucks on UK roads is electric or hydrogen-powered. Yet, by 2035, all new HGVs below 26 tonnes sold in the UK must be zero-emission vehicles. It’s clear that greater government funding is needed to incentivise greener operations. Right now, many companies will find it difficult to invest in more sustainable fleets without raising prices for customers.

In summary

Businesses across the road freight industry will be hoping the Bank of England has it right when they predict a sharp drop in UK inflation in mid-2023. Combined with falling diesel prices, lower business costs would provide operators with a shot in the arm. And if recent reforms to new driver tests help ease the driver shortage, the outlook for the industry will be even brighter.

However, supply chain issues might prove to be a more intractable issue, particularly if Brexit is the root cause. And the need to invest in greener fleets still looms large for road freight operators.

This, like many of the factors in play, might not have an immediate effect on bottom lines. It’ll certainly not halt the traditional springtime price-per-mile rise, which appears to already be under way.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn