TEG Road Transport Price Index Report – February 2025

5th March 2025

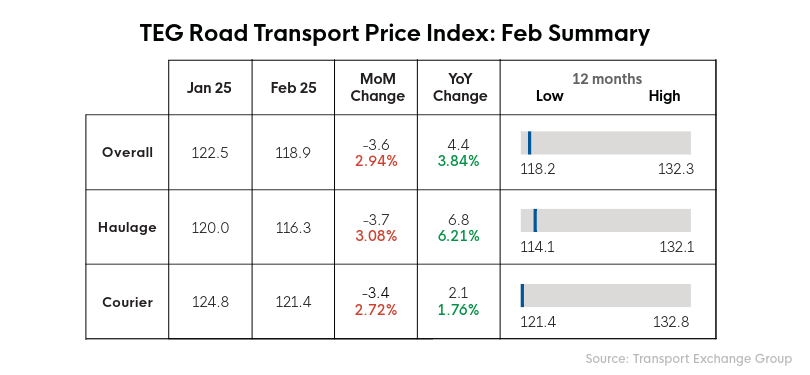

Following a drop in January, the TEG index fell further in February, reflecting what is typically a low point for transport prices in the year.

Index trends at a glance

The TEG Road Transport Index dropped further in February 2025, falling to 118.9 points. February has been the lowest month for transport prices each year since TEG reporting started in 2019. The 2.94% (3.6-point) dip was therefore in line with expectations. However, February 2025 still indexed 3.84% (4.4 points) above February 2024.

Looking at the haulage sector, prices dropped 3.08% in February. The haulage index fell 3.7 points to 116.3 points. Comparing year-on-year performance, prices were still 6.21% higher than in February 2025 when the haulage index stood at 109.5 points.

Courier prices followed a similar pattern in February. They fell 2.72% in the month as the courier index dropped to 121.4 (a 3.4-point drop). Year-on-year, the change was more muted than haulage prices. February 2025 courier prices were just 1.76% higher than in February 2025 (a difference of 2.1 points on the index).

Nobody should be surprised to see lower prices in February. That’s been the case since reporting the TEG Index, and we know to expect upward movement in March.

Industry pulse

February tends to be a month between seasons, and this typically shows in lower transport pricing. But there are reasons to feel optimistic as the daffodils come through and we welcome a little spring sunshine.

The GfK Consumer Confidence Index increased two points in February. Significantly, all five core measures have increased, with ‘general economic situation over next 12 months’ up by three points.

Other surveys echoed this optimism in the business community. The February CBI Industrial Trends Survey showed 8% more manufacturers thought output would increase over the next three months than those who felt it would decrease. The ONS Business Insights and Conditions Survey, completed in the first two weeks of February, said 20.2% of respondents thought their business’s performance would increase over the next 12 months. 16.1% thought it would decrease.

The government also reported a 1.7% rise in retail sales volumes (quantity bought) in January, following a fall of 0.6% in December 2024 and three further consecutive falls.

Interest rates came down to 4.5% as expected in February, although the Bank of England is keen to keep an eye on higher than desired inflation (3% in January).

So, there are several positive indicators right now. However, repercussions from Donald Trump’s many actions remain unknown. They are likely to impact the global economy, but it’s not yet clear what that looks like.

Fuel watch

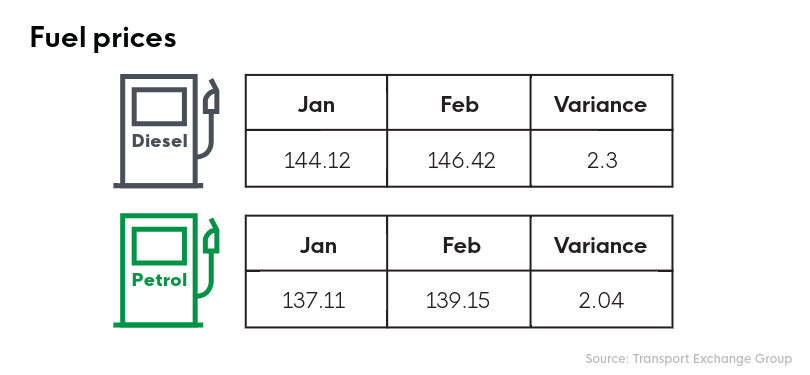

The upward trend for fuel prices continued into February. Again, the moves were modest with both petrol and diesel prices remaining lower than they were 12 months ago.

Diesel prices averaged 146.42p per litre in February. 2.3p per litre above the January figure, the monthly rise amounted to 1.6%. Back in February 2024, the diesel price was 151.25p per litre, which was 3.19% higher than in February 2025.

Petrol also continued to rise steadily in February, with an average price per litre of 139.15p. That’s 2.04p (1.49%) higher than in January. Again, the price is still lower than 12 months ago when it was 142.16p per litre - 2.12% higher.

We’ve now seen a steady rise in fuel prices since June 2024. Each month has been modest, though, with petrol and diesel following a similar trend.

30 industry leaders sign letter to Trade Secretary highlighting logistics importance for Industrial Strategy

The Business and Trade Secretary, Jonathan Reynolds, is to receive a letter signed by 30 prominent UK businesses, led by Logistics UK. They are urging him to ensure the logistics industry is a key part of the government’s Industrial Strategy, set to be published in a matter of months.

The 30 signatories include Amazon Logistics, DHL Supply Chain UK&I, Ceva Logistics, Wincanton, Port of Dover, Heathrow Airport, and Tesco Stores.

The letter highlights the importance of transporting goods for economic growth across all sectors, stating the logistics sector should, therefore, have a voice in developing future economic plans that will be published in the Industrial Strategy Council.

Logistics UK has coordinated the approach to Jonathan Reynolds. “Our sector must be recognised as a key partner in the government’s economic and business growth plans. Otherwise, the plan for growth will be set up to fail before it even starts,” said David Wells OBE, Chief Executive of Logistics UK.

“The efficiency of logistics and the growth potential of the economy are completely intertwined,” he continued. “The World Bank’s Logistics Performance Index has seen the UK fall from 4th to 19th over the past decade, due largely to congestion and delays on our roads, friction at our borders, and a long-term lack of investment in our transport infrastructure. This puts the brakes on growth across the whole economy.

But if we can reverse that trend by making the right investments, then logistics can be a powerful force for growth. Indeed, Oxford Economics has found that getting the policy and infrastructure environment right for logistics would unlock up to £8 billion a year in productivity-led growth.”

GB-NI customs arrangements continue to be “far from ideal” for hauliers says RHA

The RHA MD, Richard Smith, is urging the government to improve customs arrangements between Great Britain and Northern Ireland. He said current arrangements were “far from ideal” and contributing to a downturn in volume, with firms on both sides of the border suffering financially.

According to Parcelhero, 28% of NI-based companies said transport costs have become a challenge due to increased red tape and subsequent delays.

“Ultimately, all this upheaval means that 25.9% of transport and storage sector companies have seen their volumes to NI decrease in December compared to the previous month,” said David Jinks, Parcelhero head of consumer research.

ONS figures released in February showed 13.1% of trading manufacturers based in Great Britain said they had sent goods to Northern Ireland over the past 12 months. Meanwhile, January 2021 figures from Parcelhero suggest 20.1% of manufacturers sent goods to Northern Ireland in the previous year.

RHA’s Smith called for a coordinated approach between the UK and the EU to resolve the situation and provide firms with clear answers. This is especially timely as further changes are due to start after 31st March 2025.

Expert insight

“After six months of the TEG Haulage Index increasing at 8-10% year on year, the annual inflation rate has now dropped back to about 6%, having done its usual fall between January and February. Meanwhile, the TEG Courier Index has ended up between its last two February values – a fraction less than 2023, a little more than 2024, and also down against January because of its usual fall – February is about 97% of January across all the TEG indices. This story will start to turn around now we’re into March and Spring.”

Kirsten Tisdale – Senior Logistics and Supply Chain Consultant – Aricia Ltd

In summary

While nobody will be surprised to learn the TEG Index fell 3.6 points in February, context matters. The move was accompanied by several suggestions of an economic uptick, albeit with geopolitical uncertainty remaining.

Fuel prices continued the familiar rising trend to which we’ve become accustomed, and inflation skirts above what the Bank of England would like. But consumer and business confidence appear to be returning as spring bulbs flower and the UK economy shows further signs of relative stability.

March is usually a different story for the TEG Index, with the spring season looming for many sectors. Maybe it will provide fresh demand for the logistics sector with increasing prices following. As ever, we’ll be back next month to provide the timeliest pricing information available for the transportation industry.

Share this post on LinkedIn