September ’22

6th October 2022

Inflation and fuel prices fall for now, but TEG Road Transport Price Index continues to rise – and courier prices hit three-year high

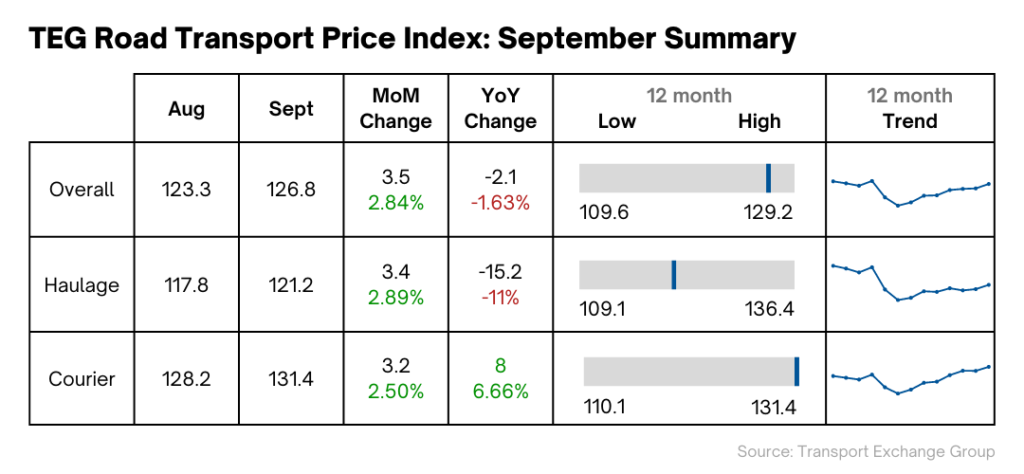

Average price-per-mile increases by 3.5 points in September, and is now approaching its own high-water mark

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

Although it’s now 2.1 points lower than this time last year, the overall index is now just 2.4 points away from its highest level. As we near enter the last quarter of the year, when prices traditionally rise, we might reasonably expect to see the index reach a new record high.

The average courier price-per-mile is already at that point, growing to a record high of 131.7 points during September.

Haulage prices are also picking up pace, rising 3.5 points over the course of the month. However, they’re still a mammoth 15.2 points down, year-on-year.

Industry pulse

In common with every other business sector, road transport will have been unnerved by the pound’s slump to an all-time low against the dollar. It looks likely that the result will be further inflation, slower growth and more economic uncertainty.

However, there are positives in terms of driver numbers and periods of high demand arriving with Christmas. Also, growth in greener fleets shows that operators are seeking to minimise costs and insulate themselves from fuel price volatility.

A brief reprieve from inflation?

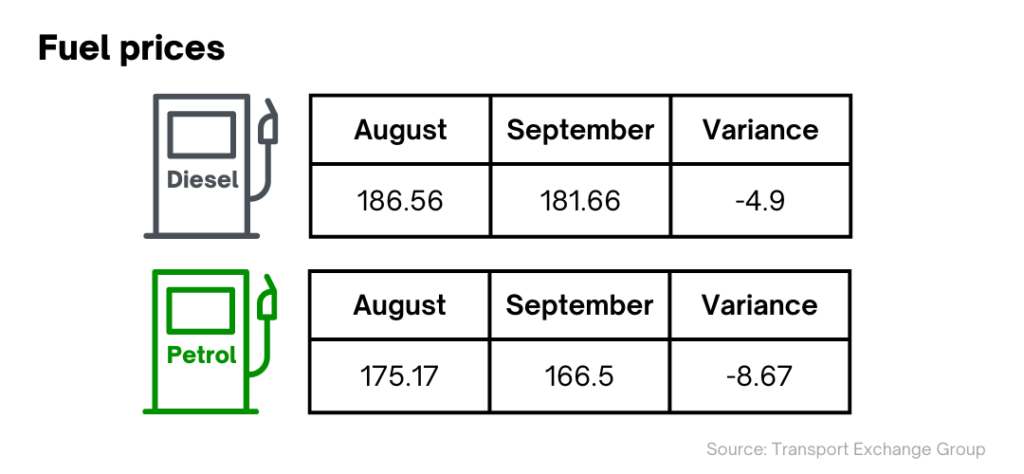

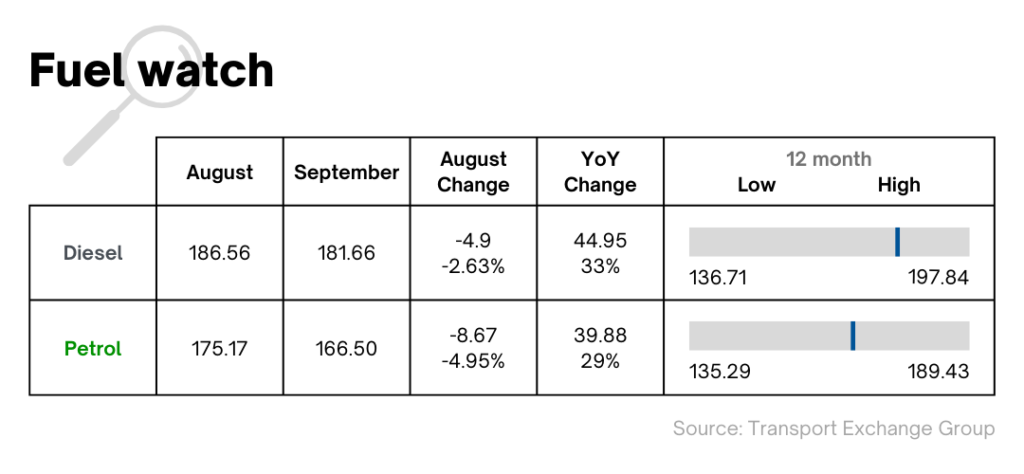

After hitting its highest level for 40 years in July, inflation fell slightly in August, aided by falling fuel prices. According to the Department for Business, Energy and Industrial Strategy, fuel prices are at their lowest since May, caused by a drop in wholesale oil prices.

Meanwhile, the annual inflation rate for just transport was 12.4% in August 2022, down from 15.1% in July.

However, the recent collapse in the value of the pound will undoubtedly reverse this trend and cause inflation to surge again. As oil is priced in dollars, a pound now buys less fuel. In addition, since Britain imports half of its food, price rises there will also add to inflationary pressures.

These macroeconomic factors could mean that road transport prices are pushed even higher.

Dwindling demand

Government figures show the amount of goods consumers bought in August fell by 1.6% compared to July, and was down 5.4% against August 2021. The amount of money spent also dropped by 1.7% between July and August.

These figures were worse than predicted, underlining just how much consumers reined in their spending this summer as energy bills rocketed. Shoppers cut back drastically on non-essential spending, with online expenditure down by 3.6% between July and August – and a huge 9.6% lower than in August 2021.

Year-on-year, overall consumer spending actually rose by 5.4% in August, but because the amount of goods bought was down by 5.4%, people effectively paid more to buy less. With recent economic developments, this trend is set to continue.

This reduced consumer activity would normally have a cooling effect on road transport prices, but there are now many other factors at play.

More hands behind wheels

According to the most recent ONS Quarterly Labour Force stats, an end to the HGV driver shortage could be on the horizon. The number of HGV delivery drivers in the UK shot up by 11% (34,000) between the first and second quarters of 2022. The current tally of 305,000 is now 4,000 higher than the pre-Covid workforce.

Even before the pandemic, however, the industry was in the midst of a decades-long, low-level driver shortage. Consequently, we can expect costs to climb in sync with short-term, seasonal driver shortages. Christmas is the obvious period when demand significantly outstrips the supply of drivers, as historical index figures show.

Fleet Figures

Traditionally, the month of August, before the September registration plate change, is one of the slowest months for vehicle sales. Registrations for light commercial vehicles (LCVs) have declined every month so far in 2022, with August figures at their lowest level since 2017, almost a quarter down on July’s figures.

While registrations of every LCV class were down, sales of both vans weighing 2-2.5 tonnes (down 45%) and vans weighing below 2 tonnes (down 44%) almost halved.

Greener fleets

Even as LCV registrations fell, registrations of battery electric vehicles (BEVs) grew by almost 15% in August – and increased by over 50% throughout 2022 to date.

Over the last year, BEVs market share has risen from 4% to 6.1%, as more operators seek to cut costs. As well as the obvious savings on fuel and tax, BEVs also come with purchase incentives and exemptions from emissions zone charges.

Volvo is seeking to make sustainable vehicles an even more attractive proposition. They’re currently testing fuel cell trucks that only emit water vapour and can travel up to 1,000km, the same distance as a diesel truck. Furthermore, instead of needing an external source for charging, they create their own electricity using hydrogen, in just 15 minutes.

While this technology is enormously promising, it remains in its early stages and BEVs also have infrastructure on their side, making them a more viable option in the short term.

In summary

The UK faces a bumpy road ahead as it battles a currency crisis and adverse economic conditions.

While road freight companies might find themselves with lower daily costs, a recession will certainly mean reduced demand. Companies will, therefore, have to become even more adept at capitalising on what demand there is. Whether they do that by embracing technology or find efficiencies another way, now is the time for the industry to prepare itself.

But the road transport industry is attempting to streamline operations where it can, particularly by introducing sustainable technology. Plus, with driver numbers back to pre-Covid levels, the sector can face any upcoming challenges with confidence.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn