October ’22

7th November 2022

TEG Road Transport Price Index decreases as the price of fuel rises again

Average price-per-mile drops by 2.7 points in October, having peaked in September

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

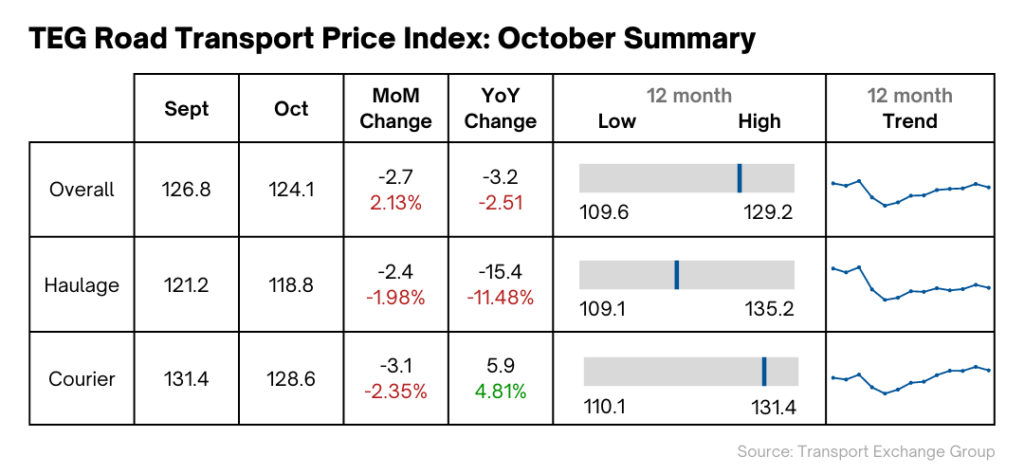

The latest data from the TEG Price Index reveals that the average price-per-mile for haulage and courier vehicles decreased by 2.7 points in October.

Compared to the figures for haulage and courier vehicles from last month and last year there has been a decrease: 3.2 YoY and 2.7 from September.

The Courier Price Index in October continues to track above the overall index with a decrease from September of 3.1 points and up 5.9 points YoY.

Haulage still lags behind the overall index at 118.8, with a decline from September of 2.4 points and a huge decline of 15.4 points YoY.

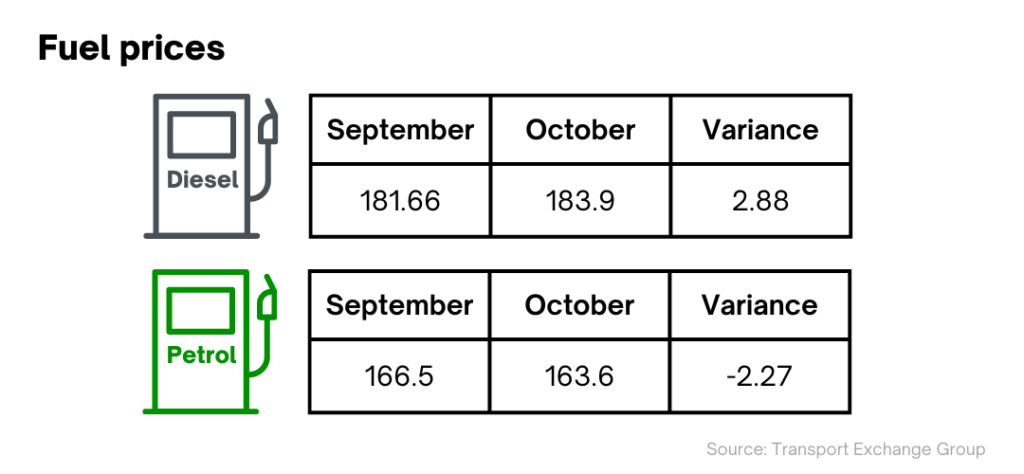

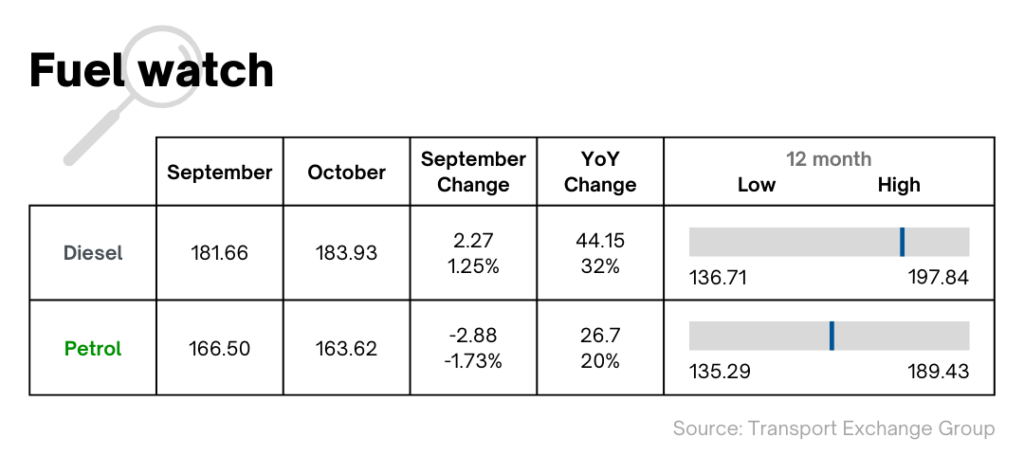

Coincidentally, from 1 October, in line with an increase in gas and electricity prices, the price of fuel started to climb again. This comes after the controversial decision by the OPEC oil cartel and its allies to cut oil production, applying more pressure across the board during this cost of living crisis. Despite strong pressure from the US, these output cuts were much bigger than expected and further squeezed supplies.

Industry pulse

Existing headwinds – including energy prices, the rising Consumer Price Index (CPI) and the escalating war in Europe – will likely see the UK enter a technical recession by the end of 2022.

Despite this, and after a turbulent few months in parliament, a new British prime minister has ushered in a calmer period for the markets and with growing confidence in UK fiscal policy, a stronger pound. A stronger pound means cheaper imports and happier consumers on the cusp of the festive peak season.

There is no doubt that the invasion of Ukraine upset world oil markets. Russia is the second largest crude oil exporter in the world (after Saudi Arabia). Therefore, as companies cut ties with Russia, petrol prices had already been rising across the world (and before that, prices had been rising post-pandemic). A globally coordinated strategic oil reserve release, pushed by the US, aimed to keep the price of oil down to help consumers as they face a surging cost of living.

However, on 17 October, a barrel of Brent crude was up at $91.62 after dipping to $84.06 on 26 September. The main reason for the rise in price in October is the production cut by the OPEC+ group. This cut reverses and the fall in fuel prices over the past few months: the efforts led by the US on lowering the cost of oil failed.

In the UK, Russian imports only make up just 8% of the total UK oil demand, with the government aiming to phase out all imports of Russian oil by the end of the year.

Driver Shortages

Driver shortages continue to be a problem as the various government and industry measures take time to filter through. In October, the Chartered Institute of Logistics and Transport (CILT) reported a spokesperson for the Department for Transport (DfT) stating that the government had ‘taken unprecedented action to tackle the global HGV driver shortage, including investing over £52 million to improve roadside facilities and lorry parking’.

However, according to PA news agency analysis of a report commissioned by the government, designated sites such as truck stops and motorway service areas do not have space for more than a fifth of the HGVs which park overnight near major roads in England. Lorry drivers are having to park in laybys and industrial estates. Suitable provision of facilities must be provided to attract more drivers to the sector as well as retaining current drivers.

Sustainability

Intermodal distribution

In the race to net zero, companies are turning to intermodal services. Coca-Cola Europacific Partners (CCEP) is mixing road and rail to distribute its soft drinks across the UK. The latest announcement will see a reduction of 4 million miles and 15,000 lorry journeys transferred to rail, with the final leg of the journey being made by road.

An intermodal approach could also support the use of electric vehicles (EV). EV technology is not yet advanced enough for HGV long-haul use. Electric heavy goods vehicles (eHGVs) are a positive step, but eHGV production and charging infrastructure availability are very limited. For example, Amazon has just five eHGVs on the road in the UK, and will have 20 on the road in Germany by the end of this year. Although we’re not there yet, this problem may not be an issue for long if the industry buys into a more intermodal approach where the hauliers need only focus on the last mile. In such a scenario, even current EV tech could meet this need.

With this in mind, there has been some recent localised activity; electrifying fleets to allow for a more eco-friendly approach to final mile delivery. DX Express division has launched a strategic initiative with Silva Brothers Limited that will start using electric vehicles for its London parcel deliveries.

Demand Watch

Supermarkets and high streets saw another sales downturn last month as shops were hit by customers’ continued cost-of-living worries and retail closures for the Queen’s State Funeral. Government figures show that the stark message from the previous month is continuing: we’re spending more to buy less. A weekly shopping budget is just not going as far as it was and consumers are cutting back on retail spending due to increased prices and affordability concerns (including the increase in energy bills).

Retail sales volumes fell by 1.4% in September; making them 1.3% below pre-coronavirus February 2020 levels. Decreasing demand for goods is a key driver for reduced road haulage and courier demand. Even taking into account that retailers closed for the State Funeral, it was worse than expected: a consensus of economists predicted retail sales would only fall 0.5% for the month. Fuel sales also fell around the time of the funeral. The ONS said there was a particular hit to fuel around the time of the bank holiday.

After increasing rates to their highest level for three decades on 3 November, the Bank of England said Britain would likely face a two-year recession, the longest for a century. This is one to continue to watch.

Confidence

The Logistics Confidence Index has unsurprisingly seen this year’s overall result slip to 50.4 from last year’s 62.5, reflecting a pragmatism within the sector as it adapts to headwinds such as escalating energy prices, high inflation and the unknown in tumultuous political and economic times.

Although global companies reported a strong performance in the Logistics Confidence Index, perhaps this is due to their larger size and key markets. This might account for the slightly less positive 45% of companies expecting to see increased profits, while 31% expect to see a fall.

However, there are reasons for optimism: there is still growth in the UK logistics market. And although 61% acknowledge business conditions are tougher than a year ago, 22% say they’re actually more favourable. Plus the majority of businesses (60%) feel confident about increased turnover in the next year.

In summary

As we approach what is traditionally a peak period, a question on many customers' minds is whether “to peak or not to peak”. After the pandemic and rapid e-commerce sales growth, we’re now facing consumer hesitation and fast-changing market conditions, such as the rising cost of energy, which could interfere with the traditional peak season.

This uncertainty is making businesses question whether to start their peak season preparation sooner or later. Some are reluctant to begin, while others are taking action earlier than ever before in the hopes of getting a share of the consumer wallet before the cold weather shifts spending towards energy.

Some retailers have been reporting that customers are budgeting by spreading the cost of Christmas over the months leading up to the holiday season and they’ve seen an increase in Christmas sales already. This shift in shopping behaviour has sparked a 219% sales uplift at Superdrug for Christmas gifts compared to this time last year.

Unfortunately, besides the cold weather, the last quarter of 2022 is also expected to bring a technical recession — but understanding the market and making informed decisions will provide the tools needed for agility so that the sector can adapt accordingly.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn