July ’22

3rd August 2022

TEG Road Transport Price Index remains stable in July as fuel price drops for four consecutive weeks

While courier prices reach their highest-ever level, the average price-per-mile for haulage drops

Integra makes sense of the road transport landscape.

Trends at a glance

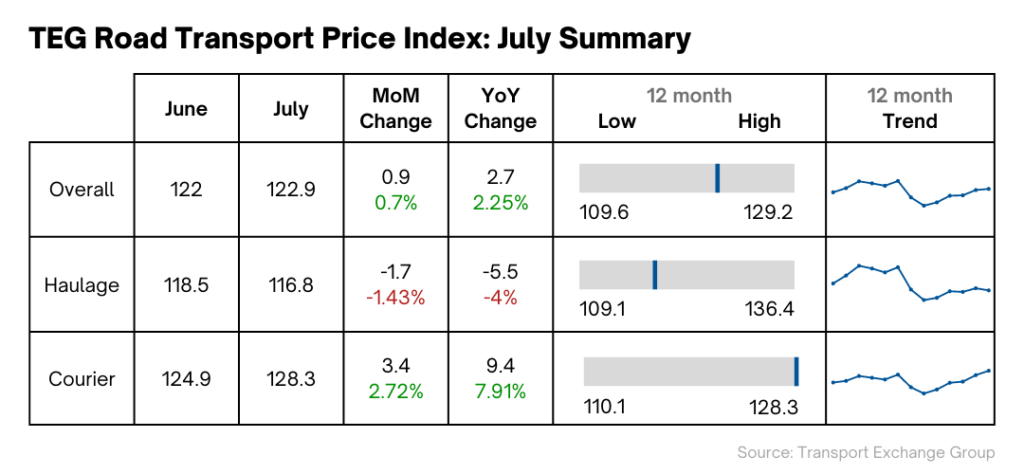

The overall index increased marginally this month, rising by just 0.9 points.

Courier prices were behind the uplift: they continued to rise, from 124.9 in June to 128.3 in July. This marks their highest level since the index began in January 2019.

However, haulage prices decreased from 118.5 in June to 116.8 in July. Although this is the fourth time they’ve dropped this year, there is a general pattern of growth following the usual post-Christmas downturn in prices.

Industry pulse

Even as inflation nears double digits – and courier rates reach record highs – the overall index appears to have stabilised somewhat. There’s no doubt that a drop in the cost of fuel has influenced this, while having greater numbers of drivers in the workforce will also be playing its part.

However, lower prices are severely offset by inflationary pressures, which are affecting every aspect of businesses’ costs.

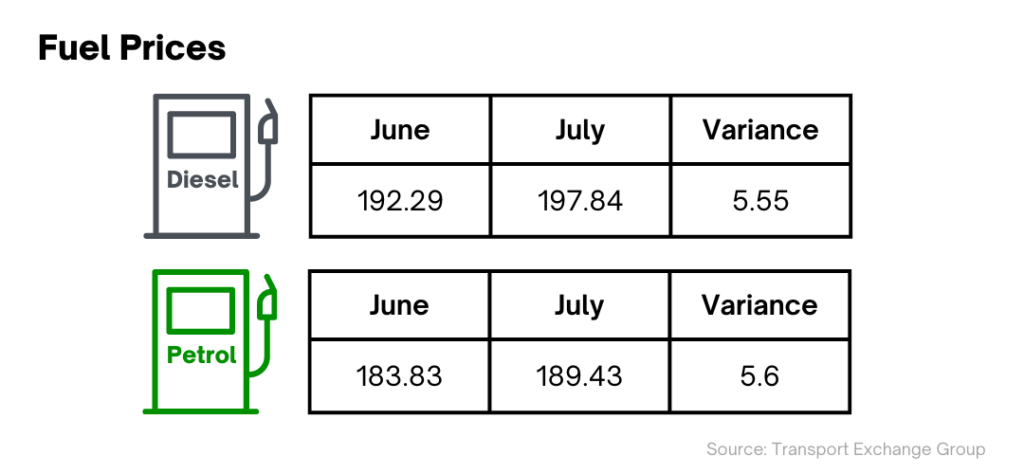

Despite the year-on-year price hikes showing a huge spike, average pump prices for fuel didn't increase as dramatically from June to July as they did the period before.

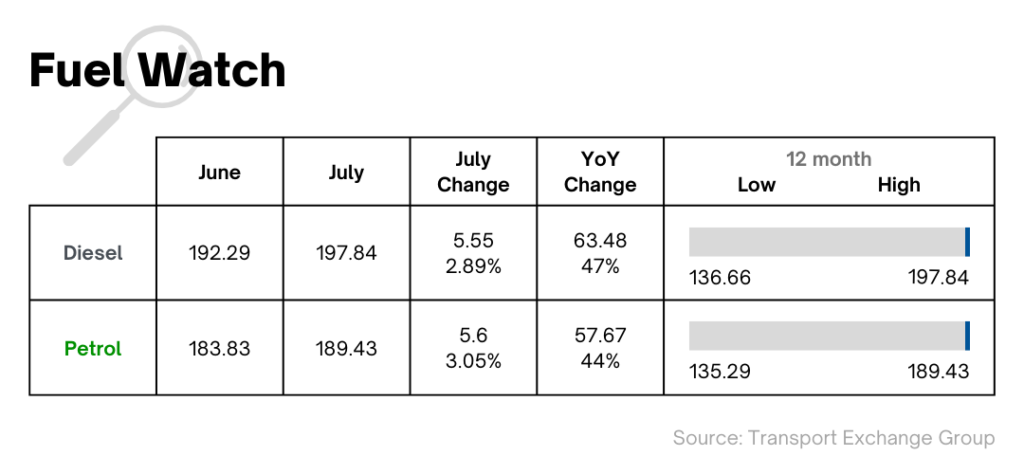

Average diesel prices increased by 6.59% from May to June, then by only 2.89% from June to July. Petrol prices surged by 10.14% from May to June, then by 3.05% from June to July. While the continuing war in Ukraine is keeping prices at higher levels, fears of a US recession hit demand for oil and drove prices down slightly.

Unfortunately, fair price cuts as a response to the lower cost of oil aren't happening — so the margins made by refineries are in the spotlight. The Competition and Markets Authority (CMA) review found ‘cause for concern in the growing gap between the price of crude oil when it enters refineries, and the wholesale price when it leaves refineries as petrol or diesel’. Wholesale petrol prices in July decreased to below 80p a litre (having reached above £1 a litre at the start of June).

Petrol retailers are making more money with each passing year. According to FairFuelUK, between 2016 and 2019, the difference between the average wholesale and pump price of fuel in the UK was between 10p and 12p per litre. In July, it stands at 35p per litre nationally.

The All-Party Parliamentary Group for Road Freight and Logistics has called on the government to introduce an immediate ‘essential user rebate’ of at least 15p per litre for hauliers.

The rising price of fuel is also adding to a competitive disadvantage for the UK road transport industry in the European market, with UK diesel prices higher than those in the EU.

Vehicle watch

According to The Society of Motor Manufacturers and Traders (SMMT) June was the sixth consecutive month that LCV registrations continued to fall YoY as supply chain shortages (most obviously of semiconductors) held the market back. June saw van registrations (2.0t-6.0t rigids) decline: on average, they were 27% below the same period last year.

Our Integra report provides more granular data on vehicles in different regions of the UK; supply and demand trends; and how factors such as haul length and delivery timings affect vehicle use.

For LCVs, will the second half of 2022 see an end to the semiconductor supply chain issues for semiconductors that extend lead times?

It doesn’t look likely, with Intel predicting the shortage will end no earlier than 2024. Intel is currently working on a solution that involves setting up new international factories — but this will take time. Even with the US introducing new legislation to encourage and fund domestic semiconductor production with $50 billion of investment, the results won’t be swift.

Cristiano Amon, CEO of Qualcomm, gave a more hopeful estimate than Intel, saying that he could envisage a return to normal toward the beginning of 2023. The lack of agreement from the top semiconductor companies shows there is still a large degree of uncertainty about when the chip shortage will end.

Driver shortages

According to ONS data the number of jobs posted related to transport is at its lowest level since April 2021. This is leading many to speculate that the actions put in place by the government are having some success.

Government measures have certainly streamlined the HGV testing process, for instance. According to Department of Transport figures, in March this year, over 10,000 people took an HGV test, a huge increase on the previous high of 7,323.

However, problems still persist, not least of all with conditions that drivers face. Until the shortfall in drivers is tackled decisively, greater demand for drivers will continue to play a role in driving road transport prices up.

Turnover & profit

We expect that as costs increase, client-facing prices will naturally go up. According to the Office for National Statistics, 28% of transport and storage companies expect to increase their client-facing prices during July and only 1.4% think they’ll reduce them.12.5% of transport and storage companies expect a decrease in turnover during July, with 19.7% expecting it to increase.

For those companies putting their prices up, this could mean less work, albeit at higher rates. While other companies could be paying rates under the index rate, thus escaping some of the fallout from higher costs. Either way, it’s likely that profit margins will become tighter.

In summary

It remains to be seen how temporary the industry’s reprieve will be in terms of fuel prices, and operating costs shown no signs of falling. Of course, consumers are also struggling with inflation, which will have a knock-on chilling effect on demand for haulage and couriers – and should keep the index from rising too sharply.

As we move towards the third quarter of the year, it would certainly be unusual to see a significant drop in prices, but the sheer number of factors involved adds its own uncertainty.

Check back here in September to see how August unravelled, as we analyse the influences having the biggest impact on the industry.

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn