January ’23

13th February 2023

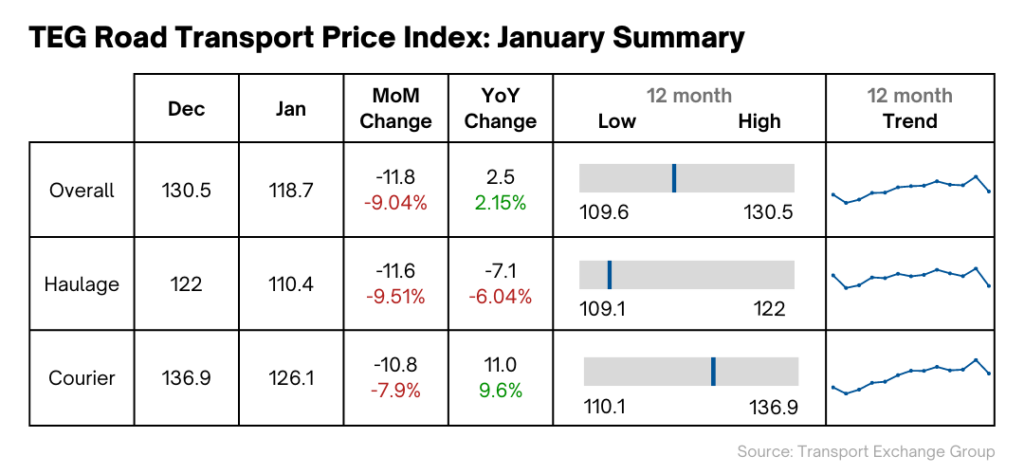

TEG Road Transport Price Index experiences usual January slump, but prices remain higher than a year ago

Strong year-on-year courier increase drives overall yearly price rise, even as figures fall sharply after Christmas

Integra makes sense of the road transport landscape. Get more insight with Integra, TEG’s enterprise solution.

Trends at a glance

The average price-per-mile for haulage and courier vehicles fell by almost 10% at the turn of the year. This followed the usual trend of Christmas peak figures and a sharp decline in January. The drop of 9% from December 2022 to January 2023 is similar to the January 2022 drop of 10%.

Both haulage and courier prices have fallen considerably from the traditional Christmas high, dropping by 9.51% and 7.9% respectively.

Despite the expected decline after Christmas, the overall index is still 2.15% up, year-on-year. This is driven by a huge 11.6% rise in year-on-year prices for courier vehicles, counteracting the 6.8% fall in haulage prices when compared to last January.

Industry pulse

Global issues currently loom large over the road transport industry. The continuing war in Ukraine is driving up costs from various angles. China reopening after Covid-19 lockdowns has the potential to disrupt supply chains, shipping and fuel costs, and demand for road transport. And the global economic slowdown is hitting the UK particularly hard: it’s the only major economy set to shrink in 2023.

All this has ensured a turbulent start to the year, both in terms of business’ expenses and demand for their services.

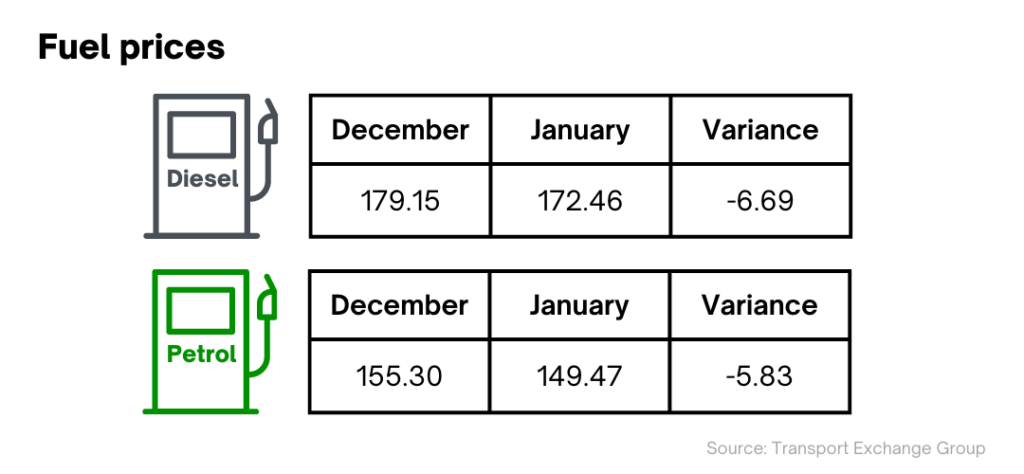

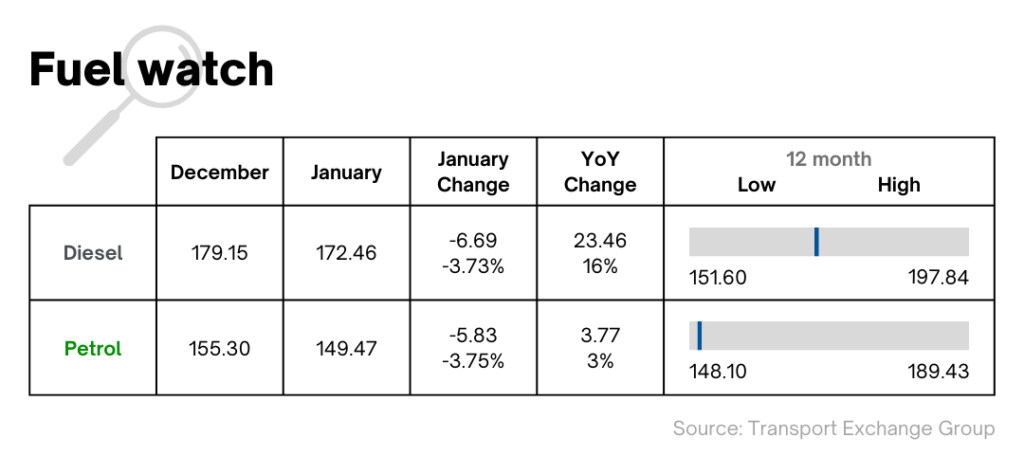

As ever, there are various forces competing to influence fuel prices. Both petrol and diesel prices have fallen by almost 4% during the first month of 2023. Year-on-year though, diesel prices remain stubbornly high, some 16% higher than this time last year. Also, wholesale fuel costs are now rising again and there is speculation prices at the pumps could be set to increase.

However, RAC fuel spokesman Simon Williams points out that retailers don’t always shift prices in line with wholesale costs. He says: “The question now is whether retailers start to bump up their prices. This will depend on whether they decide to continue enjoying larger margins or let them return to more normal levels. Looking at current wholesale costs, there is absolutely no justification for pump prices to rise."

At the same time, China is opening back up again after extremely tight Covid-19 lockdowns, with many analysts predicting an explosion in fuel demand from the economic superpower. A huge China-driven rise in fuel costs would obviously have a considerable impact on road transport prices.

There could be some comfort, however, in murmurings that Chancellor Jeremy Hunt would like to extend the fuel duty freeze for another year. If the freeze is kept in place, both petrol and diesel customers would stand to save around 12p on every litre of fuel.

Climbing costs

The immense influence of fuel prices on overall freight business costs was laid bare by the RHA’s annual Haulage Cost Movement Survey. Price hikes in key areas have caused an overall cost increase of 11.6%, year-on-year. Including fuel sees that figure rocket up to 19%.

Another pressure is shipping costs for lorry components, with the price of rubber, carbon, steel and oil all rising. While those seeking to repair older vehicles were faced with repair costs shooting up by 10%. Meanwhile, AdBlue – used for reducing nitrous oxide emissions – has been in short supply, meaning a higher price tag.

Supply issues also affected new vehicles and coaches in early 2022, when some businesses were told they’d have to wait 18 months to receive their orders – partly due to vehicle manufacturing plants being located in Ukraine’s warzone.

Of course, as UK inflation has run rampant, businesses have had to increase wages for drivers and other employees. The National Living Wage rate, for example, has risen to £10.40, while National Insurance costs have also gone up.

All in all, the last few months have seen some dramatic cost rises across the board. The result is that road transport operators are being forced to pass the increase onto their customers.

Border troubles

As the government tries to get a handle on irregular immigration, it has announced much tougher penalties for truck drivers and owners transporting immigrants to the UK illegally. The maximum penalties for each person found on a truck will now cost five times as much as before, with extra penalties for failing to secure a vehicle adequately.

Border security measures taken by haulage companies already cost the industry over £1 billion a year. Now businesses will face the risk of hefty penalties, even if they’re entirely oblivious to the ‘clandestine entrants’ aboard their vehicles.

Demand watch

On the face of it, when there’s so much demand for road transport that it cannot be met, the outlook for couriers and hauliers would seem to be positive. Sky-high demand in 2022 certainly pushed up revenues for many in the industry.

However, the unsustainable level of demand, coupled with Royal Mail strikes, meant many retailers were unable to guarantee timely deliveries. This, of course, had a knock-on effect on profits. And, longer term, if retailers are struggling, that will hit demand for road transport. A prime example is the fashion retail sector, where ASOS and Boohoo are cutting their inventories as they attempt to make savings. Fewer products to transport means less business for transportation companies.

China’s reopening could also be a double-edged sword.

Rejuvenated consumer demand from China’s huge population will provide a welcome boost to global business. And the reopening could even help to free up shipping and road transport routes – provided that large numbers of infections don’t keep the necessary workers at home.

But China’s sudden return to global trade will clearly result in much higher levels of shipping container traffic. Plus, it will undoubtedly be a shock to supply chains only just recovering from the pandemic and Russia’s invasion of Ukraine.

In summary

Global factors – including the war in Russia and China’s reopening – and their knock-on effects remain unpredictable. While the UK’s sluggish economic performance might have a cooling effect on demand.

But with fuel, wage and operating costs all set to increase further as 2023 unravels, it seems inevitable that road transport businesses will pass rising expenses onto their customers. As we continue to receive data from the industry and feed it into our price index, we’ll look out for this and other trends – as they’re happening.

Want to see more in depth data? Click below to visit the Integra Market Data report

Share this post on LinkedIn