October ’21

2nd December 2021

Since January 2019, there has been a 30% increase in what carriers are charging per mile, for both courier and haulage vehicles.

Key trends

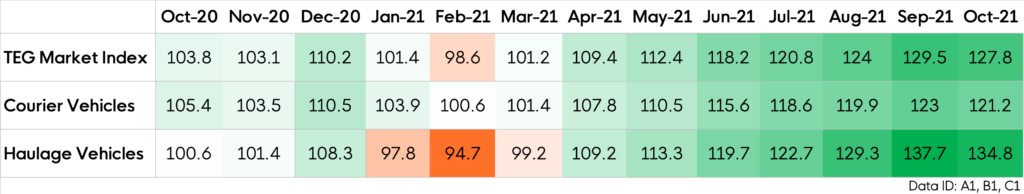

Monthly increases (4.4 points on average) began in March 2021, in the wake of Brexit. Between March and October 2021, in just six months, there has been a 26.6 point price-per-mile increase.

September showed the highest rise since January 2019, when Transport Exchange Group started recording this data, which is not surprising when considering the unprecedented demand for drivers.

Price-per-mile changes over the last 13 months

Coming straight from those inside the transport industry, the data in the index helps us understand market conditions and their effect on the wider supply chain.

The industry has come up against a perfect storm of factors. Even before Brexit and the pandemic, driver shortages were a mounting issue.

In addition to a significant number of drivers retiring each year, potential new recruits are sometimes deterred by the working hours and spending some nights away from home. Others have left the industry due to IR35 tax rule changes, making them liable for national insurance and PAYE deductions.

Brexit only exacerbated existing problems, with drivers from EU nations exiting the UK and leaving vacancies behind them. Any drivers wanting to come to work in the UK now face additional bureaucracy. With many drivers paid by the mile, instead of by the hour, border delays take money from their pockets.

Another factor making UK work a much less attractive option is the drop in the value of the pound against the euro. Being paid in pounds and paying for daily living costs in euros, EU nationals now have less spending power if they work in the UK.

The Covid-19 pandemic and its associated lockdowns caused further problems. Workplace restrictions caused huge delays in licence processing as well as driving tests, resulting in fewer newer drivers entering the market. Self-isolation rules kept other drivers off the road.

All this came against a backdrop of increased demand on supply chains, with e-commerce growing by 46% in 2020, according to the Office for National Statistics.

Now those supply chains are under greater strain than ever, resulting in the fuel and food shortages we’ve already witnessed.

“Demand for drivers is unprecedented, with various factors meaning it will remain high for quite some time. TEG Road Transport Price Index will allow anyone to take the pulse of the industry. Month-on-month, it will provide vital insight into the state of a market that’s integral to the UK’s economy.”

Lyall Cresswell, CEO of Transport Exchange Group

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn