March ’22

4th April 2022

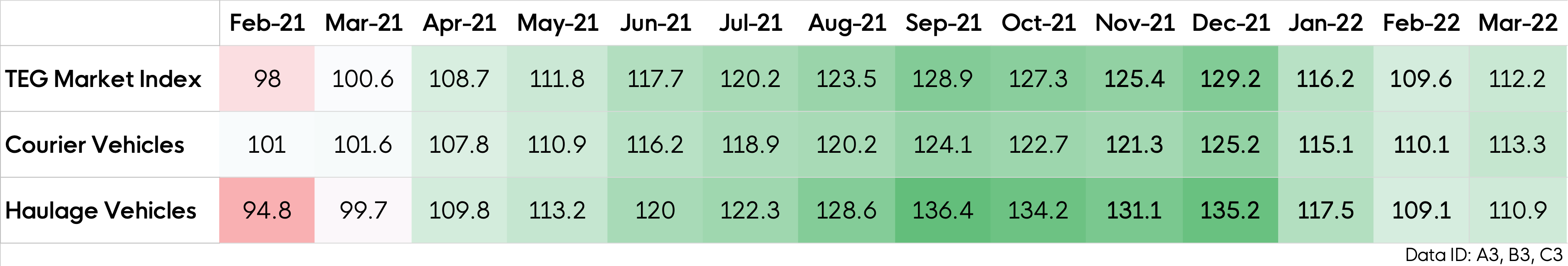

TEG Road Transport Price Index jumps by 2.6 points in March, and remains at year-on-year high

Average price-per-mile for haulage and courier vehicles follows annual February spike – and 2022 figures continue to rise above previous years

The latest TEG Road Transport Price Index data reveals March’s average price-per-mile increased by 2.6 since February, representing the highest March figure since we began monitoring prices in 2019.

March Key Findings:

March’s 2.6 point increase follows the patterns of previous years, with figures dropping between December and February, before rising again in March.

However, the overall level of the index is significantly higher than in years gone by, up 11.6 points year-on-year. This reflects continuing inflation – which hit a new 30-year high in February – and surging commodity prices.

For haulage vehicles, the price-per-mile index has risen by 1.8 points since February, marking a 11.2 point increase on March 2021’s figures. The price-per-mile index for courier vehicles tells a similar story, gaining 3.2 points since February, 11.7 points higher than March last year.

This is the second month in a row where the courier index figure has been higher than the haulage one, after an 11-month run of higher haulage numbers.

Price-per-mile changes over the last 14 months

Fuel price pressures

Even before Russia invaded Ukraine and caused even more chaos in global energy markets, the price of fuel was already rising rapidly.

Covid lockdowns in 2020 saw demand for fuel drop dramatically, taking prices with it. When economies reopened, oil-exporting nations struggled to ramp up production to meet soaring demand, forcing prices back up. In January 2021, oil was priced at around $50 per barrel, but this more than doubled in just over a year to reach about $140 in March.

Against a backdrop of rocketing inflation, rising fuel prices have placed a huge strain on the road freight industry. Although moves to reduce prices are underway.

In the UK, Chancellor Rishi Sunak’s Spring Statement cut fuel duty by 5p per litre. It has been calculated that this will save an average of £2,356 per HGV, yet smaller retailers have yet to pass the full savings on.

A more immediate drop in prices at the pumps has come thanks to a huge release of US oil reserves, which has driven down the barrel price of crude oil.

Such developments are welcome, but it remains to be seen how significant an impact they will have on the price-per-mile index.

Supermarkets squeezed

Increasing road freight costs are affecting the full supply chain, including hauliers, businesses, farmers and consumers. Food prices are set to rise further, but we can also expect shortages on the supermarket shelves.

Even McDonald’s is not immune: the fast food giant is downsizing its burgers to cope with a tomato shortage.

Going further back in the supply chain, farmers are being acutely impacted because they rely upon gas for heating greenhouses and as a key ingredient in fertiliser. Prices of ammonium nitrate fertiliser have almost quadrupled in a year, going from around £280 to £1,000 a tonne. The situation is serious enough to warrant a Defra crisis meeting.

Whatever the outcome of the meeting, one thing the food industry would dearly love to see is reduced road freight costs.

Costing consumers

At the end of the supply chain, cost of living rises have been well documented, with expenses surging for two-thirds of UK adults, according to ONS data. And now the energy price cap has gone up by 54%, the average household will be almost £700 worse off each year.

Such rises have resulted in discount supermarkets enjoying a record market share. Even those shoppers not flocking to Aldi and Lidl are increasingly turning to supermarkets’ own-label goods.

Lyall Cresswell, CEO of Transport Exchange Group, says:

“There are so many factors pushing road freight costs up right now, and the war in Ukraine is adding to an already uncertain situation. Unfortunately, there’s no end to the conflict in sight, so its knock-on effects will continue for some time. The cost of living won’t plummet overnight either.

“However, governments are pulling various levers to alleviate the situation and ease supply chain issues. How quickly we see any results is another matter, of course, and events remain unpredictable.

“One thing is for certain though, with continued inflation and high prices reflected by the index, we can expect to see another year-on-year increase in the index. Even if costs do drop, they have some way to go to reach 2021 levels and the UK supply chain needs to continue showing resilience.”

Kirsten Tisdale, director of logistics consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says:

“The TEG Road Transport Price Index went up in March: no shock there. But, although there was a different start point to previous years, it only had its normal small seasonal rise. That small rise feels like a surprise when the story for March from a logistics point of view has been diesel, diesel, diesel.

The annual rate of inflation in spot road freight is currently running at 10-11%, so this either points to little inflation in other key cost inputs or erosion of already small profit margins.”

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn