February ’22

7th March 2022

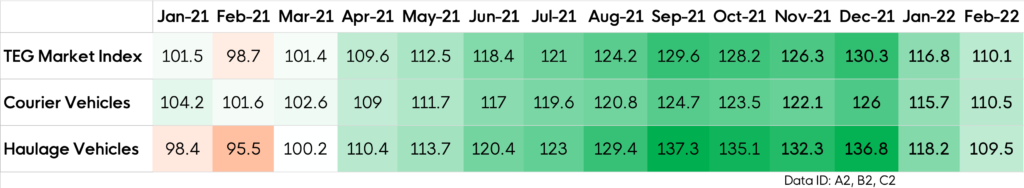

TEG Road Transport Price Index drops by 6.7 points in February, and courier index surpasses haulage.

February 2022 data shows haulage price-per-mile index fell below courier price-per-mile index for the first time in 11 months.

The latest TEG Road Transport Price Index data reveals February’s average price-per-mile for courier vehicles was one point higher than that of haulage vehicles. The last time the haulage index fell below courier figures was March 2021.

February Key Findings:

February 2022 saw a 11.4-point year-on-year increase in what carriers are charging per mile for haulage and courier vehicles.

In fact, the three previous Februarys were all around 98 points, significantly lower than the current 110.1 points.

The 6.7-point drop between January and February (and 30.2-point drop since December 2021) follows the patterns of previous years.

For haulage vehicles, the price-per-mile index dropped by 8.7 points from January to February 2022, but shows a 14-point increase year-on-year.

Courier vehicles’ price-per-mile index fell by 5.2 points between January and February 2022, but rose by 8.9 points compared to the previous year.

Price-per-mile changes over the last 14 months

The driver shortage situation in 2022

Throughout 2021, HGV driver shortages were a recurring theme and attracted high levels of media attention, particularly when petrol pumps ran dry in autumn. The retirement of many older drivers was compounded by a thousands-strong exodus of EU drivers and countless Covid-19-related absences.

The wide-ranging government response to the shortage – including driver bootcamps and accelerated testing – has helped to ease the crisis.

Undoubtedly though, the lifting of Covid-19 restrictions has also had a vital impact. In addition to fewer driver absences because of Covid-19 self-isolation, it has also been possible to process more licence applications and tests.

More than 30,000 drivers entered or reentered the industry during the third quarter of 2021, giving the sector hope that the driver shortage is being combated.

A new-look workforce

Another positive from the latest figures is that the average age of drivers has dropped, which is good news for the future of the industry.

Some 37% of HGV drivers are now aged below 45, compared to just under 34% two years ago. There are now 30,000 drivers aged between 34 and 39, which is an increase of 5,000 drivers on two years ago.

HGV bosses are also encouraging women to enter the industry, aided by increased pay packages and efforts to improve working conditions.

More work to do

Last month, executive director of the Road Haulage Association (RHA), Rod McKenzie, warned that there was still a 85,000 shortfall in drivers.

The RHA recently issued a Spring Statement to the Chancellor, detailing further actions it deems necessary for the health of the industry. These include maintaining the fuel duty freeze for another two years, investing in overnight facilities for drivers and greater flexibility on how training budgets can be used.

And prospective drivers will also need to be reassured that Brexit bureaucracy will not cause them long delays, loss of income and even mental health issues. Lengthy queues of lorries on the way to Dover recently attracted widespread media coverage and McKenzie told drivers to expect regular delays of three to four hours.

“As we all know, inflation and fuel prices are higher than they’ve ever been – and events in Ukraine and global instability will only add to that. But the haulage index falling behind the courier index is certainly a positive sign in terms of the HGV driver crisis.

Lyall Creswell, CEO of Transport Exchange Group

“Yes there’s plenty more that can be done, as the RHA have rightly pointed out, but the important thing is that the will to act is there and previous government measures seem to be having an impact.

“It’ll be interesting to see what the index shows next month, particularly as the industry comes to terms with new realities at the UK border. March will also be the first full month without Covid-19 restrictions, which should mean more drivers behind the wheel.

“As ever, lots of factors will be in play, so we’ll keep tracking the data and hope the industry proves resilient to the challenges ahead.”

“Despite fuel prices and various other indicators going up in February, the TEG Road Transport Price Index went down – the movement of the TEG index wasn’t wholly unexpected as that’s what it has done in the past three years. However, although the TEG index is still at a completely different level to previous years, the rate of decrease at the start of 2022 is sharper than it has been in other years. Let’s hope this is a good omen for inflation generally!”

Kirsten Tisdale, director of logistics consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn