December ’21

4th January 2022

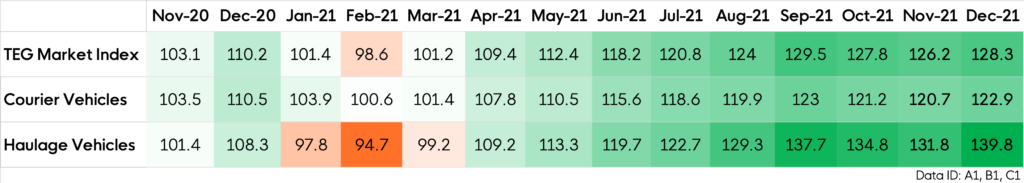

TEG Road Transport Price Index rises 5.3 points in December, reaching new record high

Following a 2-month dip, the predicted December spike in road freight rates has come to fruition.

The latest data from the TEG Road Transport Price Index reveals that the average price-per-mile has increased by 5.3 points, after September’s record high and the two-month fall that came after.

December Key Findings:

Compared to November, there’s been a 5.3 point increase in what carriers are charging per mile, for both haulage and courier vehicles.

Looking at the state of the market in December 2020, the index reveals a 21.3 point year-on-year increase, reflecting the impact of driver shortages and 10-year-high inflation in 2021. The December 2021 price-per-mile average is the highest point since TEG records began in January 2019.

Trends for haulage and courier vehicle costs in December 2021 are following a similar pattern to the previous two years. The average price increased by 7.1 points from November to December 2020, and by 5.1 points from November to December 2019.

Average haulage price-per-mile also reached a record-high in December 2021, topping the previous peak in September 2021 by 0.9 points.

In December 2021, the price-per-mile for haulage vehicles was 12.1 points higher than that of courier vehicles. This continues an eight-month run of haulage vehicle prices exceeding courier vehicle figures, since first overtaking them in April.

Price-per-mile changes over the last 14 months

A year on from Brexit

Driver shortages were already an issue before Brexit, with the UK departure from the EU exacerbating existing problems and creating new ones:

EU driver exodus

As the UK left the EU, many EU national drivers also left the UK, particularly when the Covid-19 pandemic hit and around 15,000 eastern European drivers returned home. Having opted out of the EU’s freedom of movement rules, the UK could no longer hire foreign drivers to replace those leaving or retiring, leaving a shortfall of some 100,000 drivers.

More bureaucracy and border delays

For those EU drivers still working in the UK haulage industry, there’s significantly more bureaucracy to deal with, compared to pre-Brexit times when they could cross UK borders with ease. With drivers paid per mile, delays at the border cost them money, a factor not helping recruitment efforts.

Exchange rates and tax rules

Brexit and the ensuing uncertainty have caused volatility in the exchange rate of sterling against the euro, leaving EU drivers unsure of where they stand financially. New IR35 tax rules, meanwhile, have forced many drivers away from contractor status and into becoming employees, costing them more in tax and reducing their take-home pay.

October’s fuel crisis was symptomatic of driver shortage problems, bringing the issue to the very forefront of the nation’s thoughts.

Further changes in 2022

Building upon the industry’s troubles, more changes are on the horizon. Businesses must be prepared for the full customs checks that came into effect on 1 January 2022. The end of the grace period on EU imports to the UK will increase immediate costs and congestion at ports. Once again, delays will hit companies – and drivers – in the pocket.

More changes will come in May 2022, when UK van drivers will need a new licence to enter the EU. Small traders – such as couriers and importers of wine or antiques – will be hit hard by this requirement, facing costs in excess of £1,100.

How will the industry respond to challenges?

In late November, the Road Haulage Association announced that the UK driver shortfall had been reduced by around 15,000 drivers over the previous six months. However, a significant shortage persists, with supply chain issues and high costs necessitating more government support. A raft of 32 actions includes the government-funded Skills Bootcamp, launched in December, which aims to get 11,000 drivers onto UK roads. The testing process has been streamlined to encourage more applicants, while testing capacity has been increased by a third.

“The December rise in the price-per-mile average was expected, particularly when we look back to previous years. Of course, the country relies upon supply chains more at Christmas than at any other time of year, so it only makes sense that drivers are more in demand now.

Add to this the ongoing shortage of drivers and we can safely predict that the price-per-mile average will remain high for the immediate future. It’s an ongoing challenge for the industry, at a time when there’s much apprehension around Covid-19 and upcoming Brexit changes.

The measures taken to reduce the driver shortage are certainly easing pressures though, and we should see plenty of new drivers on the roads in the New Year.”

Lyall Cresswell, CEO of Transport Exchange Group

“What we’re seeing with the TEG Index is a combination of a normal seasonal high, superimposed over driver availability and other cost issues. The uplift from November to December at the end of 2021 is not dissimilar as a percentage to that in 2019 but starting from a much higher base.

Haulage continues to track at a somewhat higher level when compared with the courier element, and we know from Logistics UK’s recent Skills & Employment Report 2021 that the latest figures show there are now less HGV than van drivers.”

Kirsten Tisdale, director of logistics consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn