April ’22

9th May 2022

TEG Road Transport Price Index rises by 5.3 points in April, reflecting previous years’ trends

The average price-per-mile for haulage and courier vehicles in April 2022 was the highest April figure since we began monitoring prices.

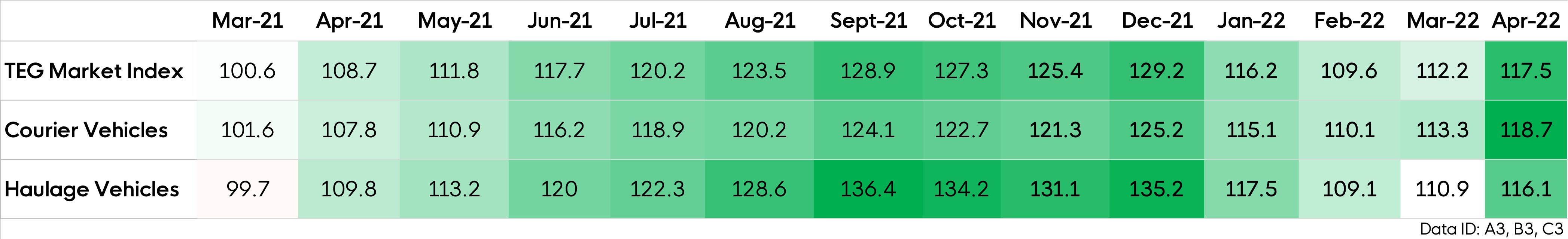

The latest data from the TEG Road Transport Price Index reveals the average price-per-mile increased by 5.3 points from March to April.

April Key Findings:

April’s increase follows the patterns of previous years, with figures dropping between December and February after the Christmas/New Year spike, before rising again in spring.

Year-on-year for April, however, the index has increased by 8.8 points. Its current level of 117.5 points represents the highest figure for April since we first put the index together in 2019.

For haulage vehicles, there’s been a 5.2 point month-on-month increase in the average price-per-mile figure. Year-on-year, it’s now 6.3 points higher than last April.

For courier vehicles, the month-on-month rise is an almost identical 5.4 points. Year-on-year though, there’s been a much more substantial 10.9 point jump, highlighting how the courier price index has caught up with (and overtaken) the haulage index in recent months.

This is, in fact, the third consecutive month where the courier index has been higher than its haulage counterpart – and the gap has widened. There are now 2.6 points between the two, compared to just a 1 point gap when courier prices overtook haulage prices in February this year.

Focusing on a specific vehicle type, short wheelbase vehicles are bucking the overall courier trend, with their average price-per-mile dropping in April. This was mainly due to a decrease in the average journey length.

Also defying trends was Wales, the only region where the average price-per-mile dropped. Greater London, by contrast, experienced a sharp 11.6 point rise across all vehicle types, more than anywhere else in the UK.

Price-per-mile changes over the last 14 months

Post-Brexit impacts

The 8.8 point year-on-year increase in the overall index has been driven by disrupted supply chains, caused by various factors. To name a few, the invasion of Ukraine, a global energy crisis and the Covid-19 pandemic have all played their part. Global logistics routes have also been complicated by China’s trade dispute with the US and Beijing’s zero-Covid strategy.

Amid all these events, post-Brexit plans are being amended and reviewed, with recent issues and discussions around delays at the EU border. Significant delays affecting haulage vehicles were exacerbated by IT problems.

Some exporters are being affected by long queues at the border, increased Brexit red tape and delays in checks on EU imports, which make UK exporters less competitive by comparison. Yet the introduction of import rules was merely delayed, meaning the landscape will shift again when imports from the EU are finally subject to full customs controls.

There are also the incoming cabotage rule changes to consider. From 21 May this year, there will be more Brexit bureaucracy with the need for a standard international goods vehicle operator licence to transport goods in the EU.

This all means the logistics industry – and the firms relying upon it – must continue to be agile and adapt to an ever-changing landscape.

Lyall Cresswell, CEO of Transport Exchange Group, says:

“We’re continuing to see that the TEG index is a result of many different factors, all of which affect the state of the industry. Haulage and courier businesses have to respond to fluctuations in costs and there will then be knock-on effects for the many industries that work with them.

“At the moment, demand for freight from these industries clearly isn’t quite what it was, largely due to cost of living rises. Consumers are buying less, which is keeping a lid on the price-per-mile figures, despite other factors, such as high fuel costs and Brexit red tape.

“Although these various factors are driving the index up enough to result in year-on-year records, trends from previous years have still emerged. The question now is whether inflationary and geopolitical pressures will continue to force prices upwards.”

Kirsten Tisdale, director of logistics consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says:

“The TEG Road Transport Price Index went up again in April – no surprise there, that’s what it’s always done at this time of year, other than when the pandemic kicked off.

“But the big question is whether it went up as much as one might expect, given the increase in key cost components. That it didn’t rise dramatically suggests strong downward pressure from customers with a wish to control inflation, combined with a reduction in the volume of goods being moved.”

Want to see more in depth data? Click below to visit the Integra Market Insights report

Share this post on LinkedIn